Looking to make their consumer lending product more appealing Goldman Sach’s Marcus is now offering loans for home improvement; the bulk of their loans have thus far been originated for debt consolidation; with more banks entering the space and the non bank lenders who have come on the scene since the financial crisis Marcus is looking to differentiate their initial offering; this is a trend across the fintech market as competition has forced firms to try to make products unique. Source.

Goldman CFO Marty Chavez said the bank surpassed $2bn in originations, a mark they were looking to reach by year’s end; the portfolio has an average APR of 12 percent, loans have an average length of four years and the typical amount if for $15,000 as reported by Business Insider; the company estimates they will reach $13bn in lending after three years in operation. Source.

Last week I was at the Digital Lending + Investing conference in New York. One of the most interesting sessions...

Last week Goldman Sachs launched a new product called GS Select. Before we get into the new product I think...

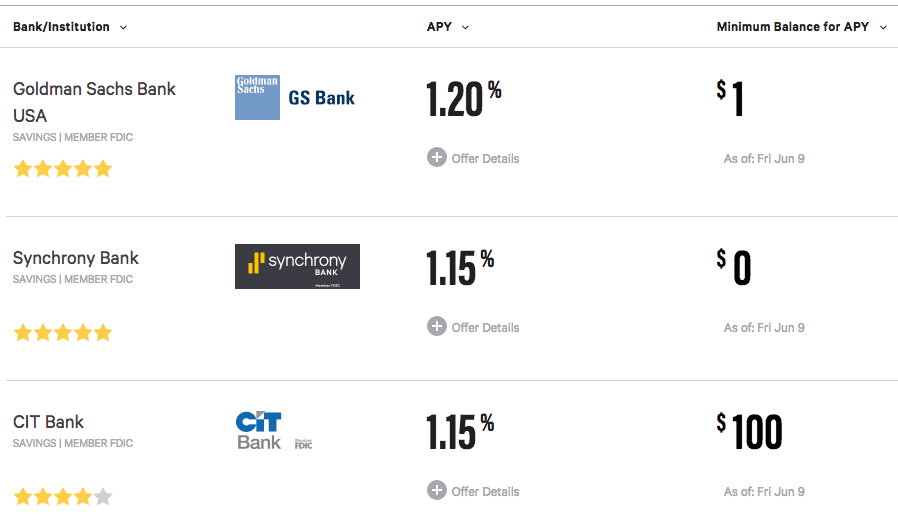

I noticed this report in Forbes last week which discussed a recent increase that Goldman Sachs was making on their...

A little over a year ago Goldman Sachs launched their consumer lending platform Marcus as part of a digital strategy...

Peter Renton, Founder of Lend Academy was at the American Banker Digital Lending + Investing conference last week; Renton reflects on the discussion with the leaders of Marcus, shares the progress of the company thus far and his perspective on Goldman's venture. Source

Marcus by Goldman Sachs was launched in 2016 and marked an important point in the consumer lending industry as they decided to build their own platform from scratch; Ainsley O'Connell from Fast Company interviews head of Marcus, Harit Talwar; Talwar shares what was attractive about getting into personal loans and details the Marcus product; stated that there were many consumer pain points and Goldman Sachs was confident they could help; Goldman also has several advantages to give them an edge; not only do they have their own balance sheet, but they essentially built a startup, leaning on 147 years of experience; they also had the advantage that there were no conflicts over any legacy consumer businesses within Goldman; the company worked closely with consumers to bring to market a product they want which Talwar discusses in the interview. Source

In an interview on CNBC last week Goldman Sachs CEO Lloyd Blankfein shared some news about their consumer lending platform....

Goldman Sachs reported its first quarter earnings on April 18 with few details about its new online lending platform, Marcus; the only mention of the new platform was in the analyst Q&A; the firm said the new platform is evolving slowly and is operating according to plans; the firm reported revenue of $8.03 billion, an increase of 26.7% from the first quarter of 2016; net earnings were $2.26 billion and earnings per share were $5.15; disappointing trading revenue was a point of emphasis for the quarter; investors are interested in more details about Marcus, which has a competitive cost advantage and is reporting potential return on assets of three times the return on assets of the firm as a whole at 3%; as Goldman Sachs progresses further with its retail business expansion, investors will be watching the retail business contribution overall which could help to cover some of its recent shortcomings and give it an edge over its competitors. Source