The easiest way to get insight into the marketplace lending securitization market is through PeerIQ’s quarterly reports. It feels like...

The Senior Managing Director at Kroll Bond Rating Agency discusses trends in marketplace lending securitization. Source

Peter Renton reviews his 2017 marketplace lending predictions and shares projections for 2018. Source

Peter Renton shares returns from his marketplace lending portfolio as of Q3 2017; overall returns for Renton’s portfolio was 6.64%; declining performance in the portfolio is primarily due to LendingClub loans; new additions to his portfolio for the quarter include AlphaFlow, Money360 and YieldStreet. Source

While giving a keynote speech at LendIt Europe 2017 Upgrade CEO Renaud Laplanche laid out his three biggest predictions for the near future; the growth of online lending will accelerate in the next 15 months, a meaningful secondary market will develop and rebundling will give birth to one major consumer product innovation in the next 15 months. Source.

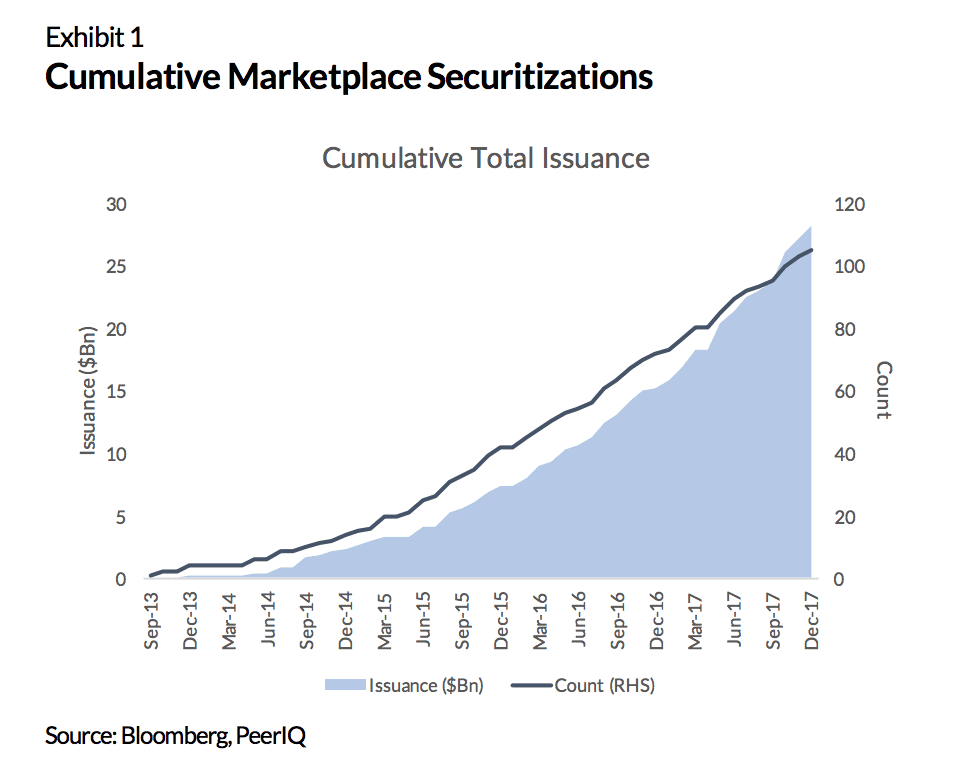

The report shares the highlights of securitization in the space which totaled $7.8 billion in 2017, up from $4.6 billion in 2016; SoFi was the leader in both volume and total number of ABS deals; report includes KBRA’s outlook for 2018, loan origination and ABS issuance by platform, performance and rating trends and more. Source

The Financial Stability Oversight Council's annual report includes a section discussing the risks of marketplace lending. Source

Lend Academy shares some of the biggest news stories of the year; includes Mike Cagney departing SoFi, the Cleveland Fed retracting their report on “p2p lending”, Prosper’s $5 billion deal, Renaud Laplanche’s new venture and more. Source

The CEO and Co-Founder of Younited Credit talks banking, technology, Brexit, and his international expansion plans. Source

PeerIQ released their third quarter marketplace lending securitization report; total issuance for the quarter was $2.6 billion down from $3 billion in the last quarter; SoFi closed two consumer deals and one student deal; Lending Club and Prosper both issued one deal; College Avenue issued their first ever student loan securitization. Source