This Forbes piece digs into how financial services companies might be impacted by the Coronavirus; both Visa and Mastercard have...

Visa and Mastercard currently rank 7th and 11th on the S&P 500; their stock prices have increased around 50% over...

Mastercard is already working with names like Brex, Revolut and TransferWise; they have also announced programs in order to make...

China’s central bank as accepted Amex’s application to start a bank card clearing business, but they still need to receive...

Facebook plans to reveal their crypto plans next week and now they count a group of impressive backers to support...

Mastercard has gained approval from the People’s Bank of China (PBoC) to enter the Chinese market as a bank card...

Pleo is a European fintech that automates expense reports and simplifies company spending via their smart corporate prepaid cards; today...

Fintech platform SoFi has struck a new exclusive partnership with card issuer Mastercard to be the sole issuer for SoFi...

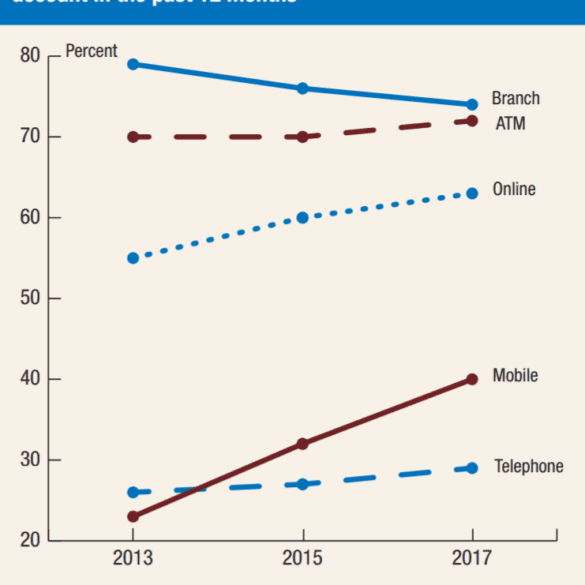

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Mastercard is launching a partnership with UK fintech Yoyo Wallet; Yoyo is a mobile wallet that can be used at...