Every quarter, LendIt co-founder Peter Renton shares his marketplace lending returns; in this blog post he shares his Q4 2019...

I am certainly late with this but I have finally found the time to bring you my quarterly returns report...

Peter Renton shares returns from his marketplace lending portfolio as of Q3 2017; overall returns for Renton’s portfolio was 6.64%; declining performance in the portfolio is primarily due to LendingClub loans; new additions to his portfolio for the quarter include AlphaFlow, Money360 and YieldStreet. Source

Money360 is a marketplace lender for commercial real estate; in Q2 the company closed $143 million in loans making Q2 the company's largest quarter; to date the company has closed $350 million in loans and expects to surpass the $500 million mark by the end of the year; the press release provides further information about the deals closed. Source

Money360 has reported another milestone in the nascent online lending commercial real estate market; the firm has originated $100 million in new commercial real estate loans in the past six months, doubling its total from August 2016; four recent loan closings for a total of $38 million helped the company reach its $200 million milestone; Money360 says it expects to exceed $500 million in loan transactions by the end of 2017. Source

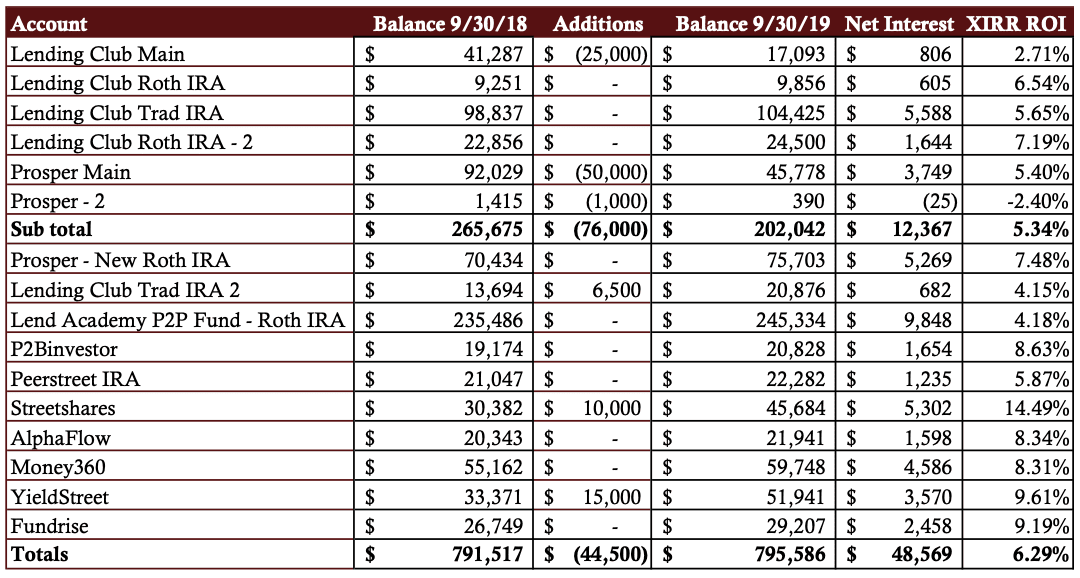

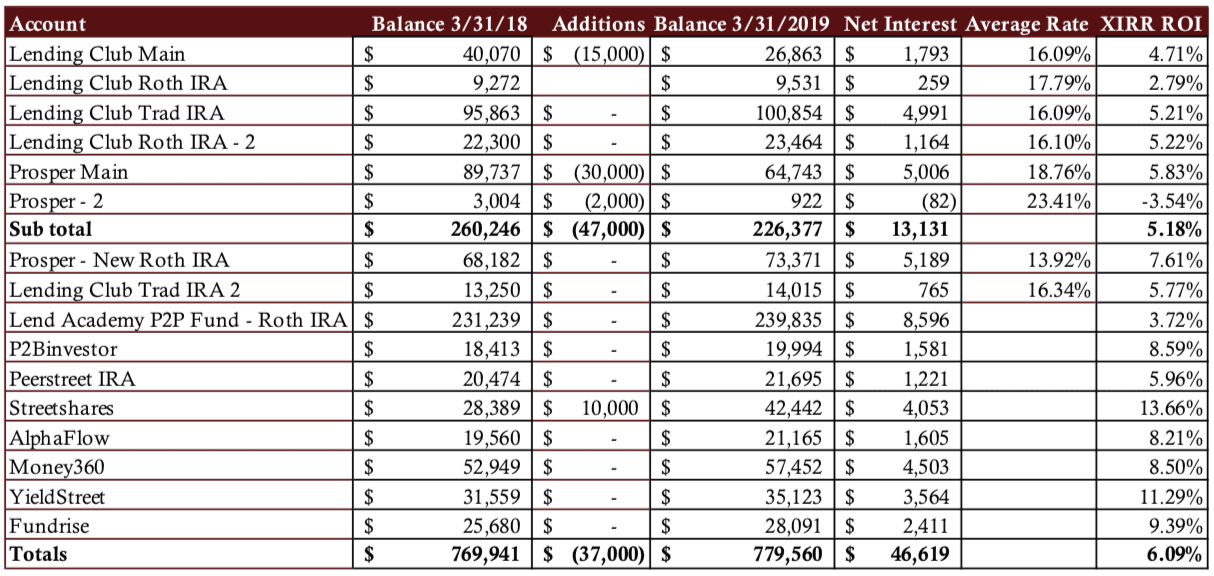

Every quarter Peter Renton, Founder of Lend Academy and Co-Founder of LendIt Fintech shares his investments in various marketplace lenders;...

Put this in the “better late than never” department. Yes, I know it is late July and I am only...

The partnership will focus on Money360 providing pre-arranged financing options for eligible commercial properties listed for auction on the Ten-X platform; financing options on these properties will be transparently disclosed on the platform and Money360 will work with buyers to complete the underwriting, processing and closing of the loan; the partnership expands deal flow of commercial properties for Money360, which utilizes technology to enable commercial real estate loan transactions from $1 million to $20 million. Source

Pi Capital International LLC has advised Money360 on a $250 million structured debt facility; the funding comes from a financial institution in South Korea; Pi Capital was able to facilitate the transaction through its global alternative capital network. Source

Ron Suber has invested in online commercial lending platform Money360 and will also join the firm as a strategic advisor; Money360 has been growing fast and estimates loan originations will exceed $500 million by 2017; the investment will add to Ron Suber's fintech portfolio which he is managing from a family office; his equity investment follows positive returns from loan investments on the platform. Source