2020 is off to a fast start when it comes to fintech financings and M&A deals as the past week...

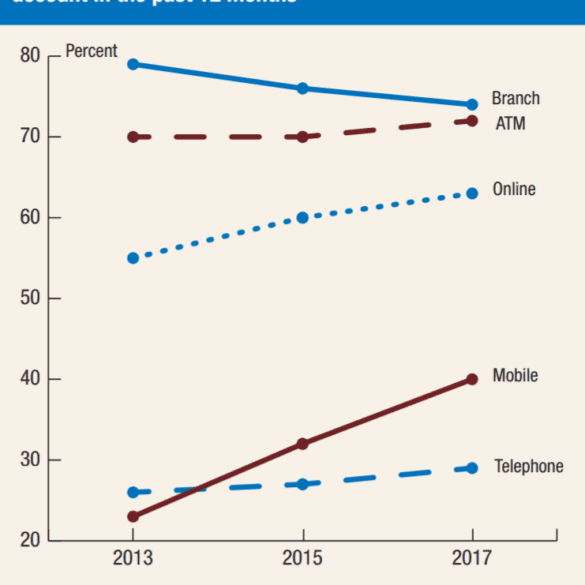

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Get ready for MEMX, or Members Exchange, as a group of nine retail broker-dealers, banks, and financial services firms plan...

PeerIQ released their Q4 2018 Lending Earnings Insights Report which points to a number of themes showing the economy is strong...

In this week’s PeerIQ Industry Update they cover the continued growth in the jobs market with the unemployment rate dropping...

According to the Wall Street Journal, E*Trade has five million retail customers including $360 billion in assets; Morgan Stanley will...

Morgan Stanley knows how important data is to the core of their business and in 2018 they created the data...

Quantum computing has the potential to dramatically affect banking in the coming years, especially from a cybersecurity standpoint; banks like...

Morgan Stanley recently bought more than $14mn of local subordinated bonds from online lender Geru Tecnologia e Servicos; Brazil has...

Morgan Stanley CEO James Gorman sent a memo to employees signaling their focus on technology innovation; American Banker reports that...