The Federal Home Loan Banks have been around since 1932 but their mission has changed from support for affordable housing to liquidity provider for banks. This has had a profound impact on the financial system.

Bunq has become one of the first European digital banks to enter the mortgage market with an announcement that they...

In a Forbes column, the CEO of Hometap, Jeffrey Glass, discusses credit scores and how most lenders still rely on...

Regulators in the US are contemplating giving banks additional regulatory points for lending to mid and low income Americans who...

Zillow purchased Mortgage Lenders of America in November 2018 and now is officially launching Zillow Home Loans as they rebrand;...

On episode 40 I talk with John Paasonen of Maxwell helping lenders serve their communities by channeling mortgage and technology expertise.

Mortgage fintech Blend is on a roll; Blend’s customer base now accounts for more than 25% of the $2.1 trillion...

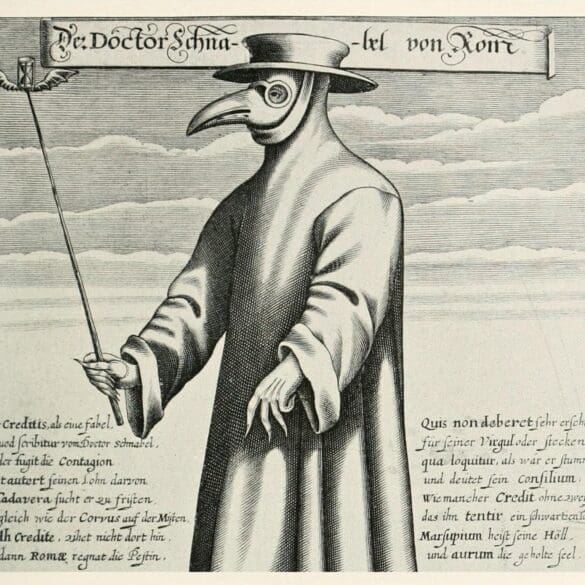

This week, we look at what positive innovations could arise from the pressure cooker of the pandemic. I touch on health care data and privacy, molecular technology, digital work- and play-spaces, and their financial implications. Channeled productively, the next decade could see advances in these fields that we can't yet imagine.

The securitization includes £285 million of UK prime buy-to-let mortgage loans and was oversubscribed; Citi arranged the securitization who was...

JPMorgan Chase ran a pilot last year which offered bonus rewards to customers of their Sapphire credit cards if they closed a mortgage; JPMorgan experienced significant demand from the pilot with homes purchased doubling for those who owned the Sapphire cards; the bank is now expanding the promotion to other credit cards they offer; Business Insider shares more on JPMorgan’s market opportunity and the millennial demographic. Source