N26 has shared that they have crossed 5 million customers, up from 3.5 million last summer; in 2019 they added...

There is no question that challenger banks like Revolut, Monzo and N26 have acquired massive amounts of customers; it leads...

TechCrunch reports on metrics provided by N26; the digital bank currently boasts 3.5 million customers in 24 European markets including...

Germany’s financial regulator has ordered N26 that they need to “take appropriate internal safety measures” and “comply with general customer...

AltFi takes a look at overdrafts in the digital banking market, both arranged and unarranged; their research found that Starling...

The digital banking space in Europe has been fascinating to watch. Customers seem much more engaged and willing to move...

Last year we saw continued interest in a broad array of fintech companies. Recently the fintech space has become more...

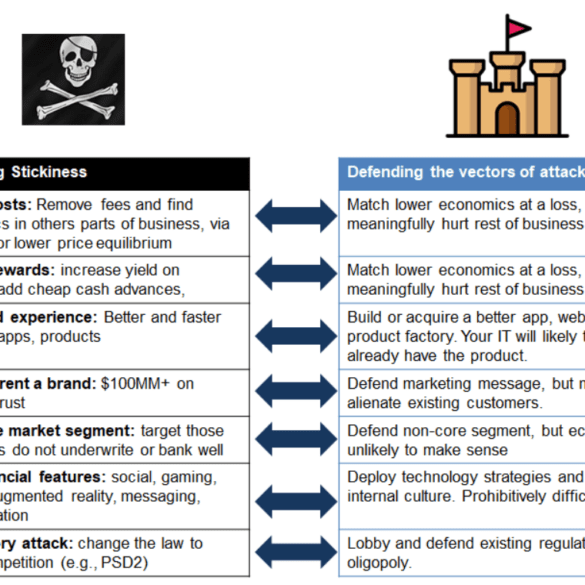

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?

U.S. Bank launches app to take pain out of filing expenses Bankers Expect AI To Make Your Financial Life More...

CFPB to give more information to firms under investigation The head of Credit Suisse’s blockchain efforts said culture is the...