Latin America's neobanks showed growing profits and robust customer acquisition in the quarter, a sign of resilience amid economic troubles.

Warren Buffett-backed Nubank reported a 44% increase in profits in the second quarter, as it expands its customer base in Latin America.

Nubank is the top receiver of customer data, outlining fintech's significant opportunities in Open Finance in Brazil.

Despite a challenging scenario for Latin American fintechs, neobanks and digital wallets in Brazil continue to sign up millions of clients.

Nubank is developing a risk appetite for unsecured loans, while it expects to roll out payroll lending in the following quarters.

Brazilian neobank Nubank reached 90 million customers in Latin America and reported a surge in profits in Q3.

Fintechs in Latin America market high-yield saving accounts to win customers off from traditional financial institutions.

Nubank's second product in Mexico was well received. Country manager Ivan Canales discusses the market strategy with Fintech Nexus.

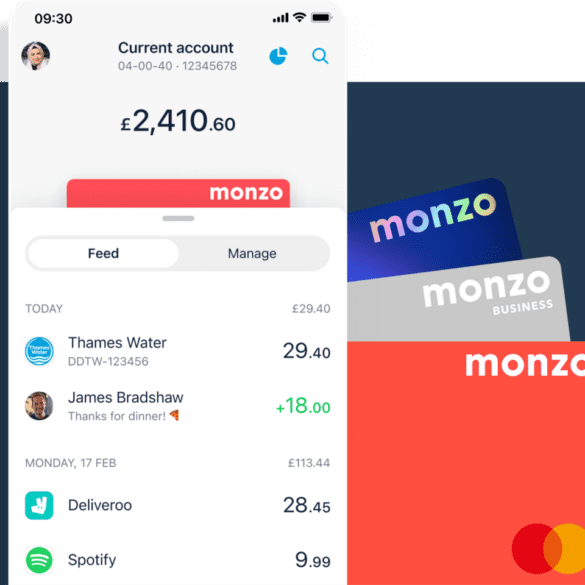

For the second time this week, we can take time to celebrate some good news in the lending space, as Monzo reported monthly profitability for the first time.

Nomad, which offers dollar accounts to Brazilians, will now allow its customers to pay in installments for purchases made abroad.