Shares of Nubank have weakened since its initial public offering, losing some $20 billion in market value since it went public.

After exactly two years since the last in-person event, Bo Brustkern and Peter Renton took to the LendIt keynote stage to welcome hundreds of Latin American fintech and financial services executives.

LatAm fintechs have a massive advantage over traditional financial companies: a lack of a robust, cost-heavy physical infrastructure that thwarts cross-border expansion.

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

Marc Butterfield, SVP of Innovation and Disruption at the First National Bank of Omaha, said that the results were significant when FNBO ran tests.

In 2021, firms who had stayed alive through the initial pandemic became giants: fintechs became banks, banks became super apps, and super apps became some of the most successful public companies in the world.

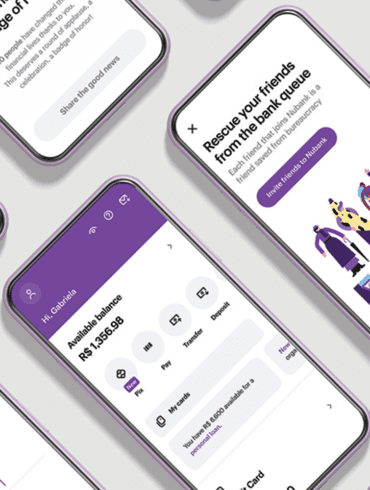

David Velez founded Nubank in 2013 with the idea of taking on big banks in Brazil and leveraging technology to change how financial products are served in the country radically.

We are focusing on Latin America again this week in the lead-up to LendIt Fintech LatAm next month. This week...

Many of these firms have aimed to go public in the vague "end of 2021/ early 2022/ when we have enough money" time frame while participating in increasingly rare-letter funding rounds.

We have seen many companies in fintech branch out into adjacent areas of finance as they add product lines to...