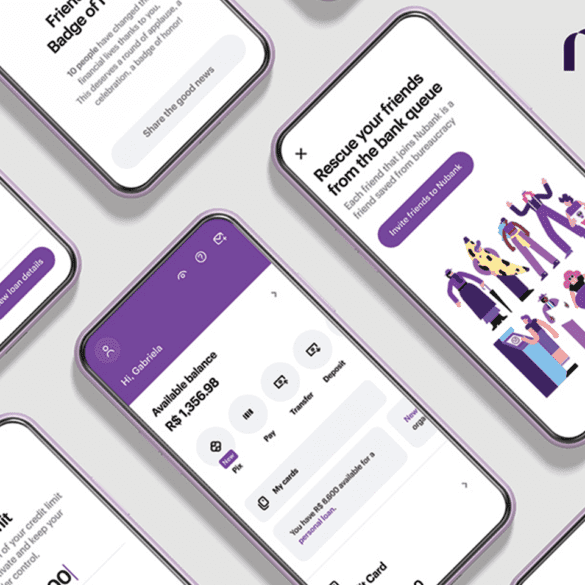

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

In this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.

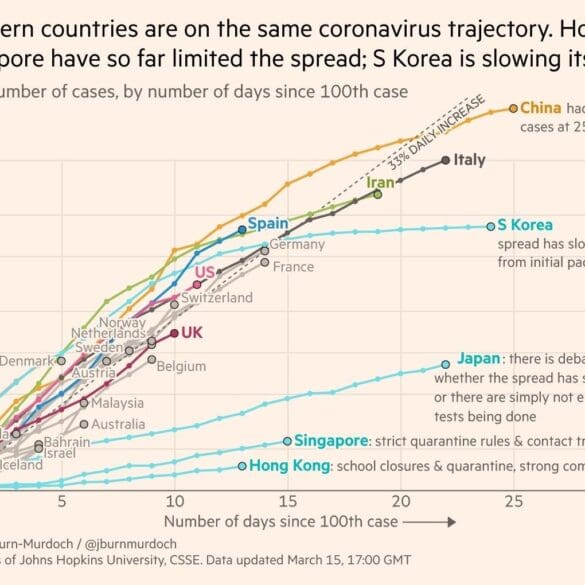

I hope that you and yours are OK, socially distanced and stocked on essentials. Whether you feel it yet or not in daily life, the world is bracing for coronovirus impact. In this week's analysis, I look at the difficult trade-offs between health and economy, and try to quantify the impact of the likely slow-down. We look at some grim but useful concepts, like (1) the value of a statistical life, (2) what happened to the Soviet economy and life expectancy after perestroika, and (3) how our financial machines (NYSE, Robinhood, Maker DAO) are cracking at the edges. If you can do one thing -- be kind and gracious with each other as some things inevitably break.

Hexindai, a Chinese fintech company listed on the Nasdaq last Friday; according to the article Chinese firms are getting pressure from investors who want to cash out; tightening regulations are also a factor; Qudian, another firm went public last month and Rong360 may be the next Chinese fintech company to go public; Oliver Wyman reports that the market size for consumer lending will expand to $620 billion by 2020 with a compound annual growth rate of 49%. Source

Today, Lending Club released an updated S-1 filing for its upcoming IPO. In this document is the long awaited confirmation...

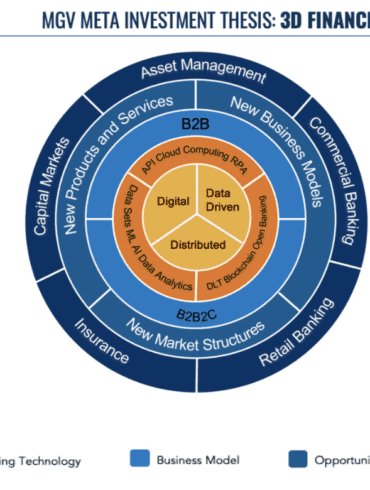

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

The New York Stock Exchange, operated by Intercontinental Exchange, has decided to go all digital and close the trading floor...

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

Two weeks ago I wrote about China Rapid Finance and their plans to go public. I shared information about their...