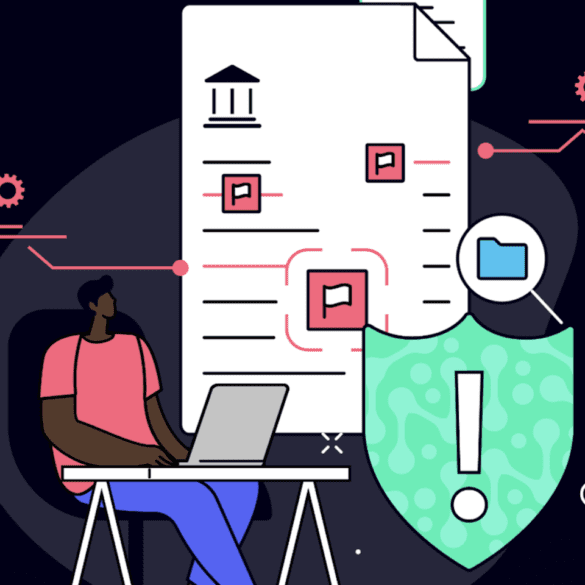

Fraud is a significant challenge for lenders, impacting both operational efficiency and financial stability. Legacy methods for detecting fraud are proving to be inadequate in the face of new techniques, so AI-powered detection is needed.

In this episode, we talk with Sam Bobley, the CEO and Co-founder of Ocrolus, the leader in intelligent document automation. They work with most of the fintech small business lenders and are expanding into consumer lending and mortgages.

SMB lender Lendflow announced a partnership with Ocrolus to determine borrowers' viability and provide critical access to capital.

The Paycheck Protection Program has had its fair share of issues with government bureaucracy and favoritism by big banks to...

[Editor’s note: This is a guest post from Tim Dubes, Vice President of Marketing with Ocrolus, a cloud platform for...

Although generative AI's development is a concern to some, its application to the lending sector could create even more access to credit.

Traditionally a time-consuming process, Ocrolus has released an automated fraud detection software to aid lenders.

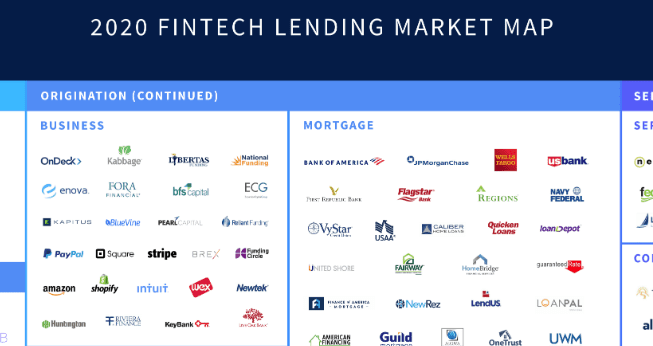

Those of us who have been around the online lending space for a while will remember the “Lendscape” created by...

In this week’s PeerIQ Industry Update they cover the mixed economic news at the end of 2019 into early 2020;...