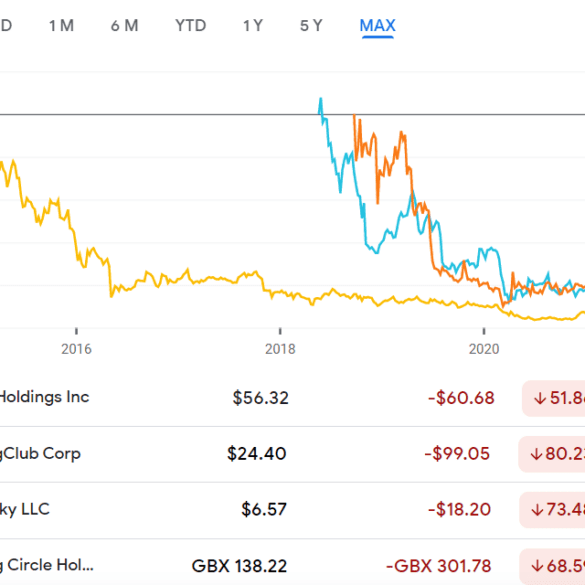

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

The fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

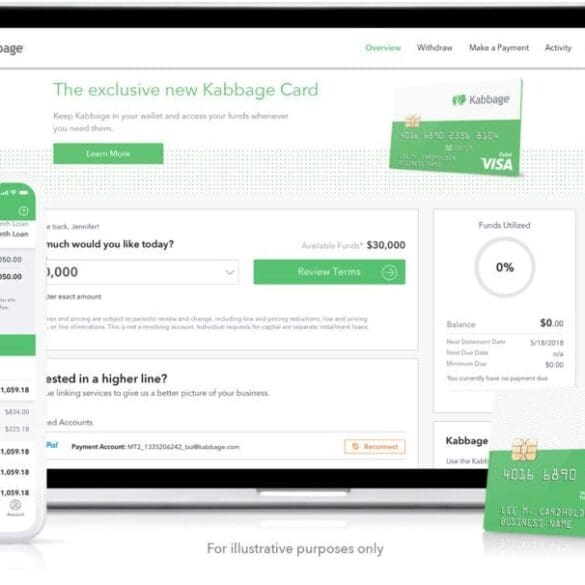

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

New York is set to follow California is requiring non-bank lenders to disclose metrics on each loan; metrics include total...

OnDeck is currently engaged in talks with creditors about a corporate debt facility which the company still owes about $92mn;...

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. In this episode, we talk through a few recent events that are indicative of the Fintech world right now. Brex raised an additional $150 million at a slightly improved valuation vs. its last round just as Monzo is reportedly looking at a 40% down round. Why? Shopify launched bank accounts for its merchants and announced the Shop app, basically an Amazon competitor plus Klarna, just as it worked with Facebook to support the launch of Facebook Shops and joined the Libra Association. Lots going on. Lastly, we discuss why Goldman’s M&A activity over the past couple years leads to the natural conclusion that they should buy Schwab.

Recovery, Re-Boot, Resilience: Roadmap Back to Growth August 25th at 2:00 PM ET: Register Today Banks, Lenders and FinTechs have...

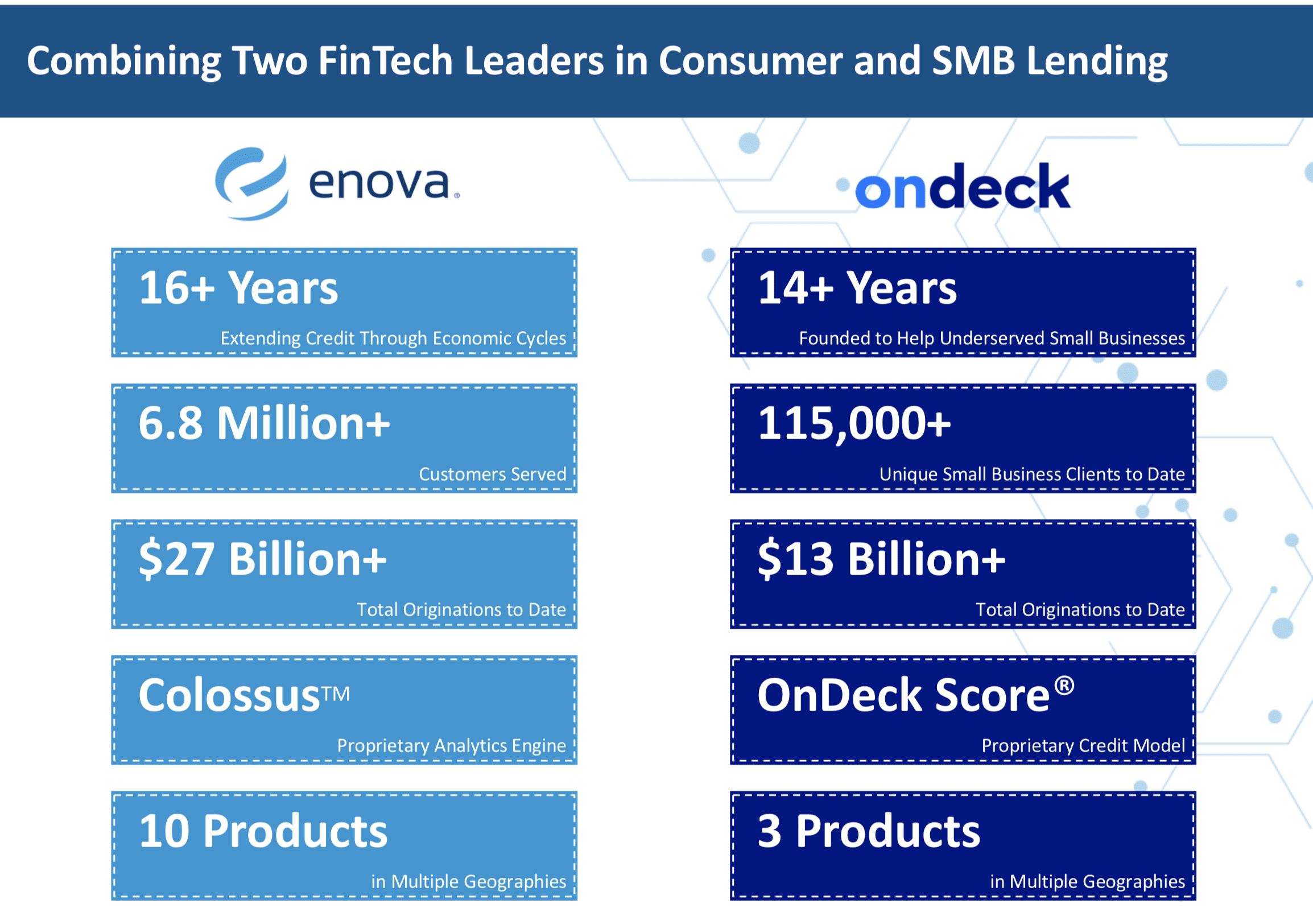

In a deal that will rock the fintech space Enova announced this afternoon that they are acquiring OnDeck for $90...

What Banking For The Unbanked Means For You PPP spotlights shortcomings in credit unions’ small-business push Splitit is quickly adding...

Online lenders have felt the brunt of the current crisis as many of the platforms operate on a marketplace model...

OnDeck shared a mid-quarter update to investors and the outlook isn’t as bleak as previously thought by many; OnDeck has...