There has been a lot of uncertainty over the last 2 months, especially for fintech lenders. OnDeck found themselves in...

Forbes shares the current reality which is that some fintechs will have to sell in order to survive; OnDeck is...

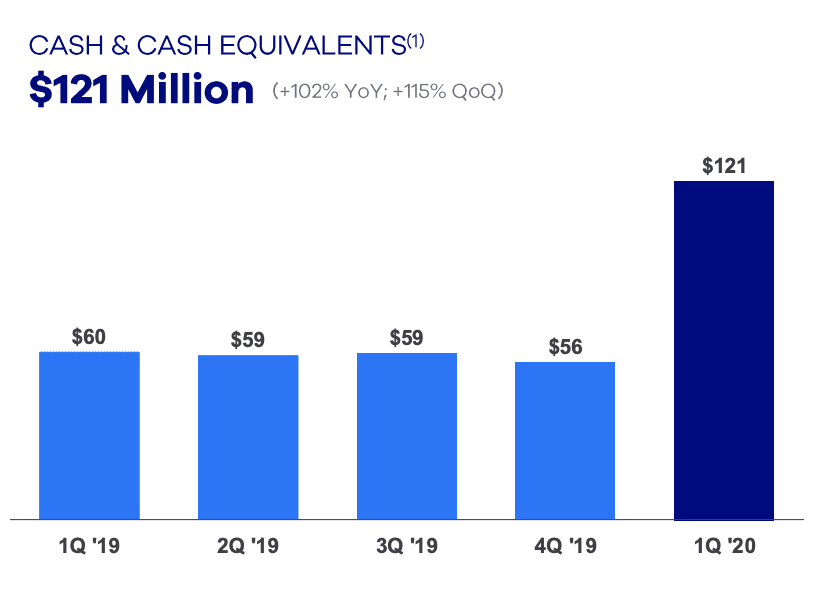

OnDeck lost $59mn in Q1 2020 as their streak of seven straight quarters of profitability came to an end; the...

OnDeck shared yesterday that they are now able to serve small businesses who are seeking capital under the Paycheck Protection...

JPMorgan Chase finds itself overhauling their digital strategy team as they leaders in the unit have moved on to other...

All of the leading online lenders are struggling as the economic crisis continues to get worse; many have cut originations...

In this week’s PeerIQ Industry Update they cover the continued crisis across the online lending landscape; even with the crisis...

It has been an interesting to say the least as we have watched everything play out with the Paycheck Protection...

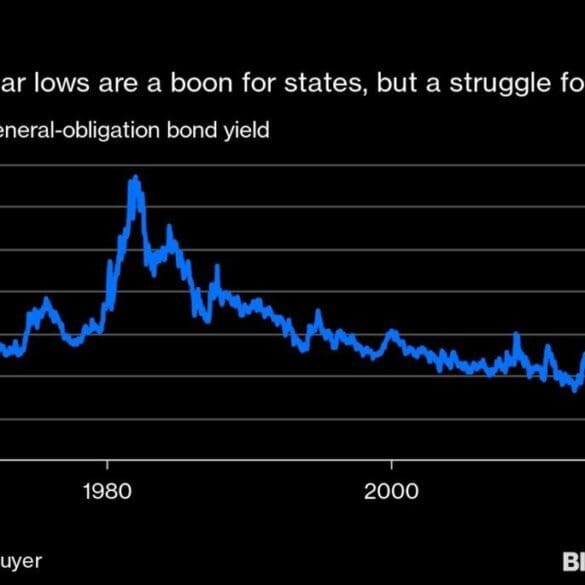

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

I started writing about marketplace lending back in 2010, so I have spent almost the entire decade immersed in this...