OnDeck’s Q2 financial results included a handful of interesting updates from the company, but the news of losing JPMorgan Chase...

OnDeck had some pretty interesting updates in their earnings release which took place earlier today. CEO Noah Breslow shared that...

In this week’s PeerIQ Industry Update they cover the troubling data of millennial delinquency rising significantly higher than older borrowers;...

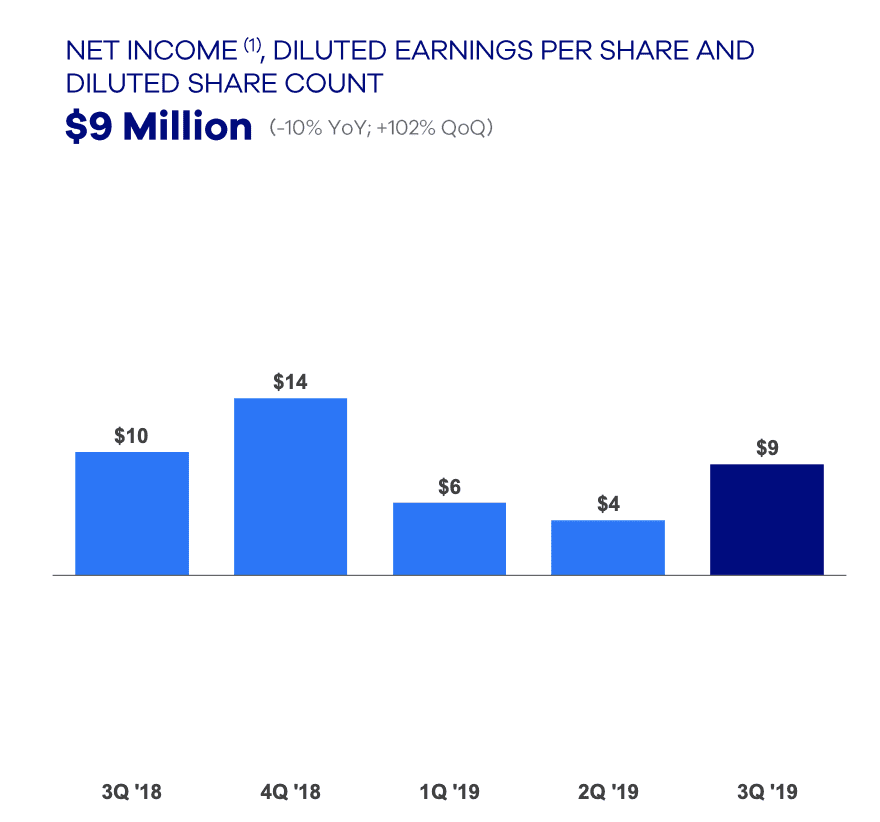

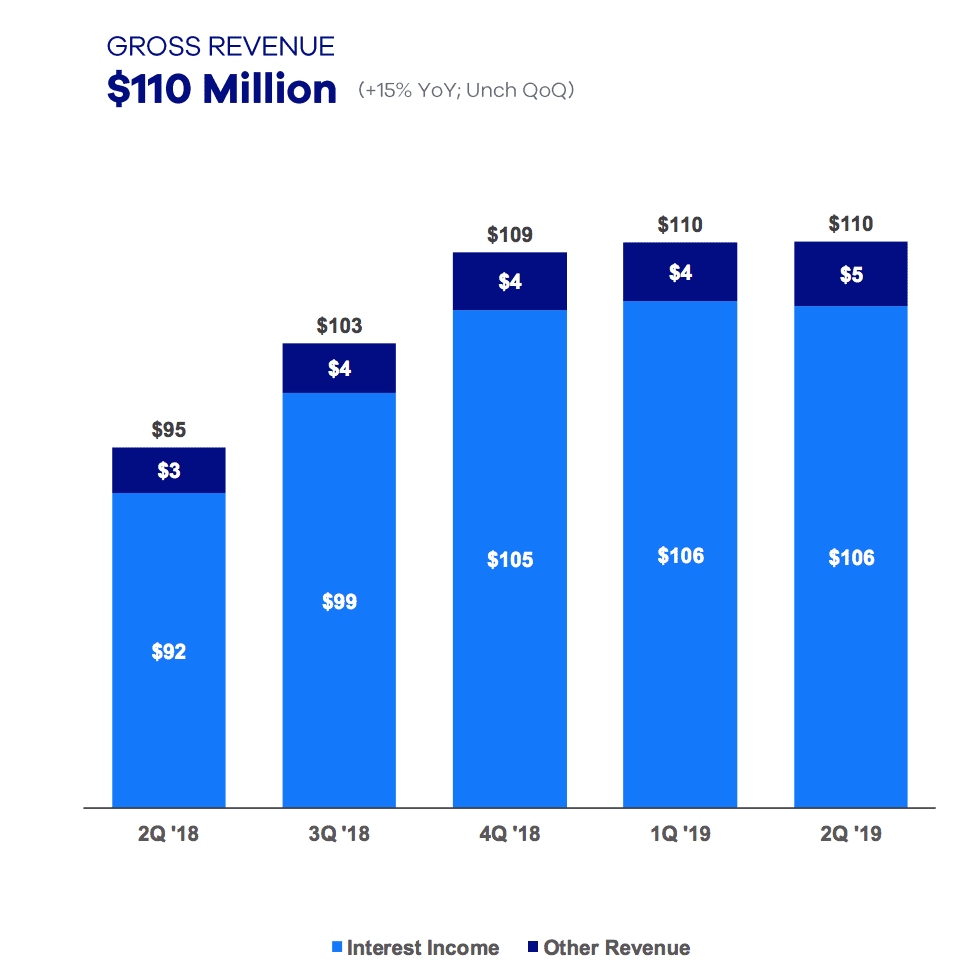

Every quarter we check in on the public online lenders. This includes LendingClub, OnDeck and GreenSky. LendingClub and Greensky reported...

P2P lending fund cites legacy Zopa portfolio for lower returns Digitizing construction finance with Rabbet’s Will Mitchell AI Is Coming...

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.

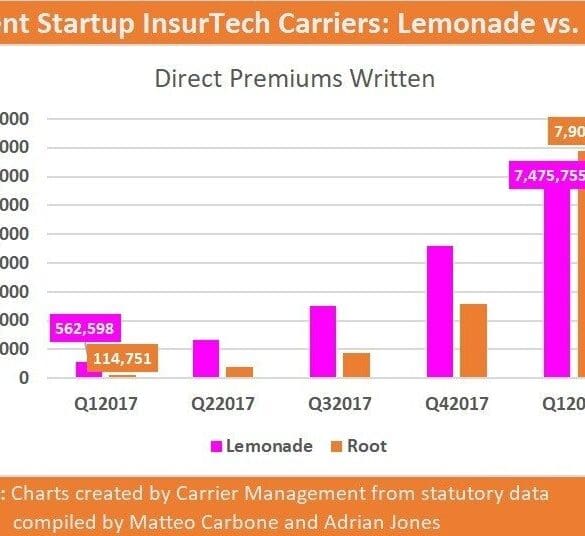

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

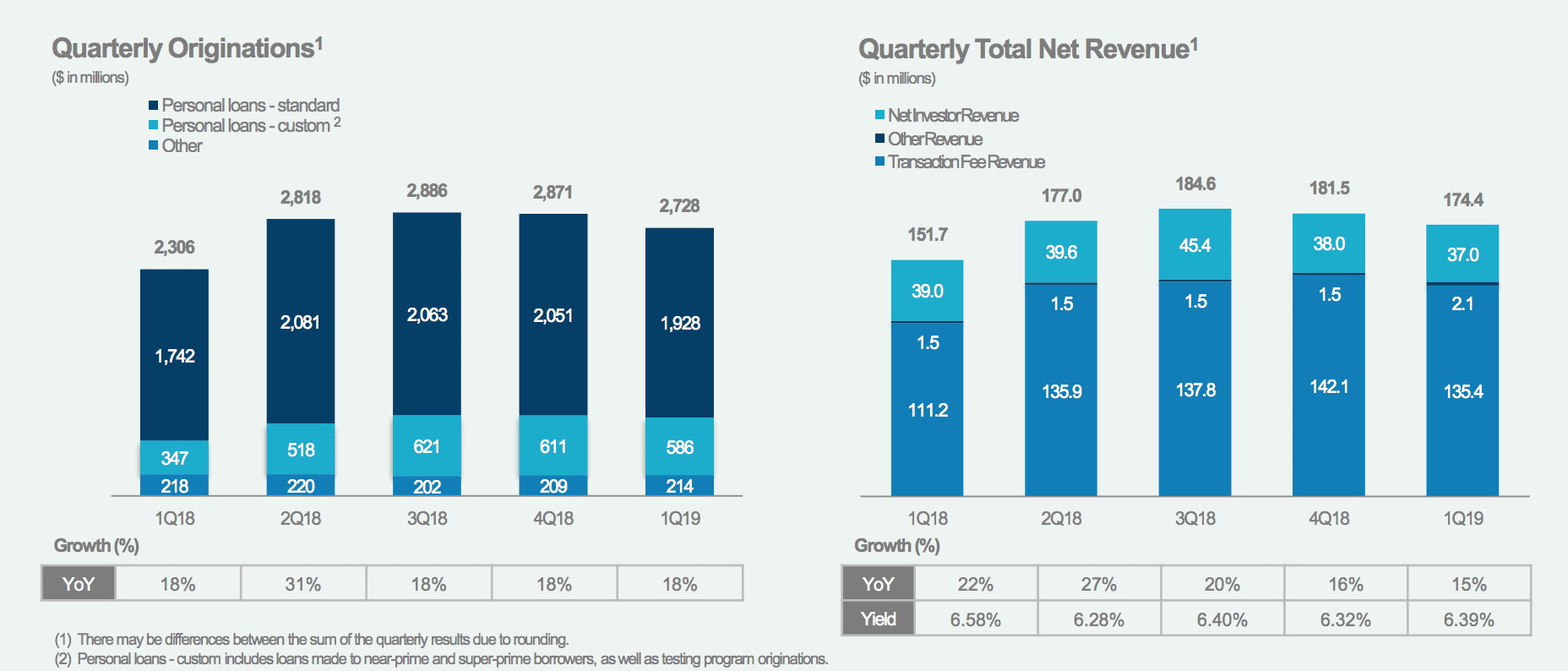

We recap the earnings results from LendingClub, OnDeck and GreenSky; LendingClub is off to a good start in 2019 and...

OnDeck reported first quarter earnings yesterday and total originations dipped for the quarter coming in at $636 million compared to...

OnDeck is combining their Canadian business with Evolocity Financial Group which is a Montreal-based online small business lender; the combined...