This morning OnDeck announced their second quarter 2017 earnings. In addition to the earnings release and webcast, we were able...

On OnDeck’s Q4 2016 earnings call we learned that the company was cutting 11% of its staff resulting in $20...

It has been reported that Kabbage is interested in acquiring OnDeck Capital. S&P Global recently published an analysis of a potential deal. This week Kabbage announced a new originations milestone of $3 billion since inception. We take a closer look at the originations and pro forma estimates of the two companies provided by S&P Global.

OnDeck's annual originations have increased from approximately $15.9 million in 2008 to $2.40 billion in 2016. Estimates from S&P Global show combined loan originations for the two firms of $3.82 billion for 2016. In addition to synergies from similar balance sheet and securitization funding sources, S&P Global also notes the increased value Kabbage could likely bring to OnDeck's line of credit product. Pro forma estimates put line of credit originations at approximately 50% for the combined entities. Kabbage has considerable expertise in small business line of credit lending and it's a product OnDeck launched in 2013 and has recently been focused on. Source

New York-based hedge fund Marathon Partners Equity Management LLC is actively pushing OnDeck Capital to reduce costs and reach profitability more aggressively than it has already outlined; the firm owns approximately 1.75% of the company's outstanding shares; Mario Cibelli is the primary spokesperson for Marathon Partners and says he contacted members of the board in March to urge for deeper cost reductions and analysis on a potential sale; it is likely that Marathon Partners could gain a board nomination from the discussions; OnDeck Capital could also see more involvement from hedge fund shareholder EJF Capital LLC which has said in public filings that it may also reach out to the company to discuss its future strategy. Source

Small business lender Kabbage is planning for a new equity fundraising, targeting a few hundred million dollars; sources say the lender is considering potential acquisitions including a buyout of OnDeck; Kabbage has reported a number of recent successes including a partnership with Banco Santander, expansion to Ireland and the industry's largest asset-backed securitization of small business loans. Source

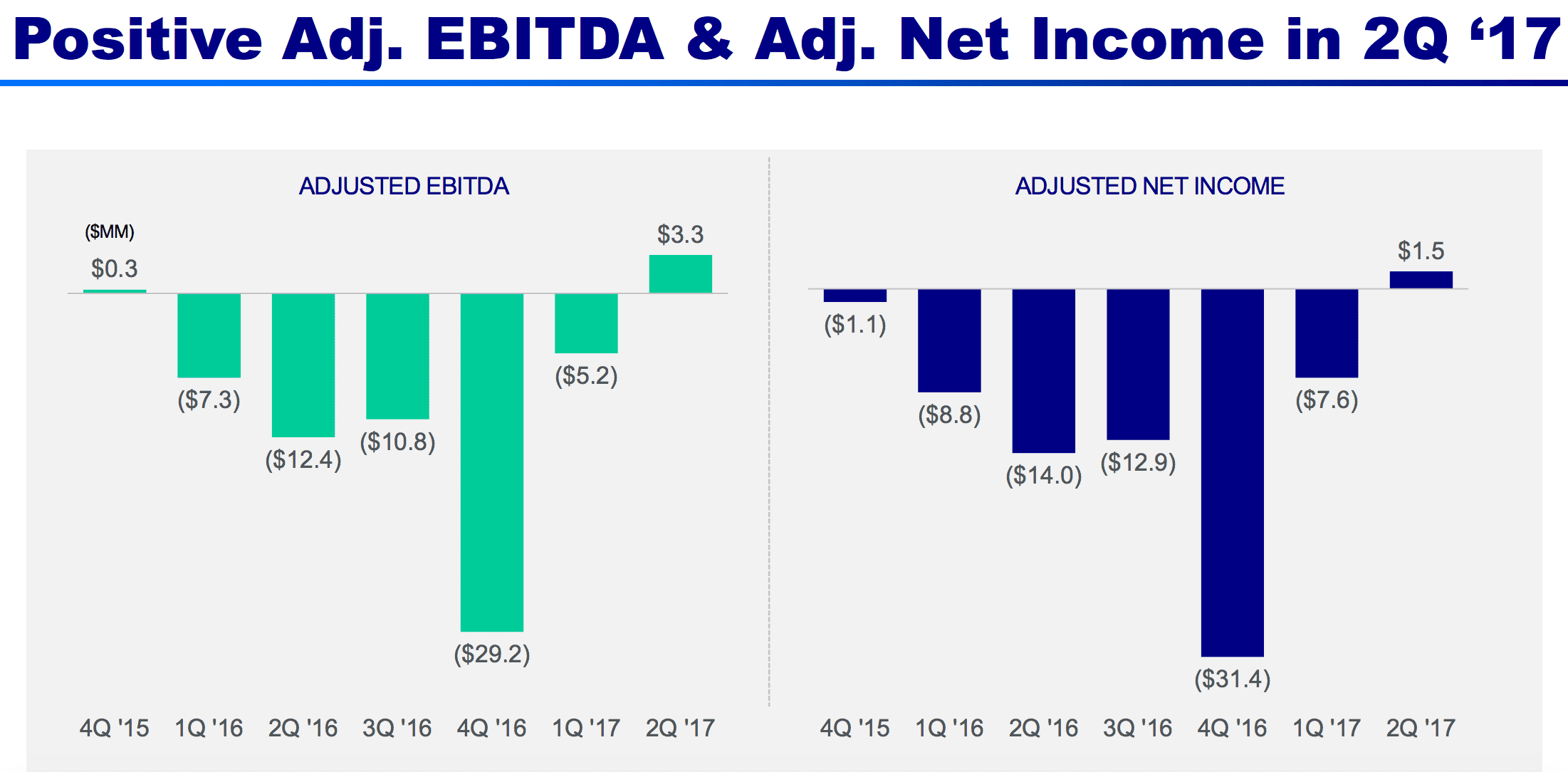

OnDeck Capital beat earnings estimates and missed revenue estimates for the second quarter; revenue was $86.85 million, increasing 25% from the comparable quarter; earnings per share were $0.02, increasing from -$0.20 in the second quarter of 2016; loan originations decreased from $589.7 million in the second quarter of 2016 to $464.4 million in the second quarter of 2017; company reported success in acceleration to profitability; expanded online lending partnership with JPMorgan for up to four years; deBanked provides their perspective on the earnings release. Source

In a letter to the board at OnDeck, Marathon Partners has outlined changes they want to see enacted; Marathon believes OnDeck has put a premium on growing their originations instead of getting costs under control and growing shareholder value; additionally they have been disappointed with OnDeck's corporate governance and executive compensation practices; the private equity firm recommends the lender cut costs to get them under control and seek the sale of the company to a stable partner. Source

Kabbage is reportedly considering an acquisition of small business online lender OnDeck; S&P Global analyzes a potential merger between the two firms which has high value deal prospects including combined 2016 SME loan originations of $3.82 billion, costs savings from similar balance sheet and securitization funding sources, and similar success in technology licensing partnerships, overall resulting in increased margins, earnings and more competitive terms to borrowers; the valuation metrics and negotiation factors are the main constraints to a potential deal; the minimum enterprise value reported by S&P Global is $291.7 million which is below its current market cap of $372.4 million and far below its original IPO valuation of $1.3 billion; key factors to watch for 2017 will be OnDeck's forecasted EBITDA and fundraising obtained by Kabbage. Source

Bloomberg provides insight on factors involved in a potential takeover of OnDeck Capital after rumors on Thursday that Kabbage was considering an offer to acquire the firm; it seems OnDeck's shareholders would likely veto a takeover with 45% of the company still owned by its original investors; as a private company, the structuring of the deal terms for Kabbage would also be difficult and to gain any interest from OnDeck's shareholders they would have to offer a considerable premium. Source

The marketplace lender has extended the maturity of its credit facility with Deutsche Bank to March 2019; the revised terms also add an additional $52 million to the credit facility; in comments regarding the revised terms, Howard Katzenberg, chief financial officer of OnDeck said, "The closing of this transaction reflects a continued ability to execute our financing strategy for 2017, which includes extending debt maturities and creating additional funding capacity for future loan growth." Source