In Orchard's Weekly Online Lending Snapshot, the company introduces a new section on US marketplace lending funds and highlights the growing business also noting RiverNorth's November 17 webcast, "Incorporating Marketplace Lending into an Institutional Portfolio"; notable data points from the snapshot include monthly gains in publicly traded companies for Lending Club, Yirendai and Square; in UK listed funds, the Ranger Direct Lending Fund continues to lead returns with a monthly gain of 2.27%; the RiverNorth Marketplace Lending Fund also has a monthly gain, with a return of 0.84%; in securitization the snapshot has Lendmark Funding Trust as the most recent securitization with a pricing date of October 26. Source

Orchard's Weekly Online Lending Snapshot for the week of October 27 focuses on new marketplace lending securitizations and the snapshot's new tracking for recent securitization issuances; other key data points from the week include Yirendai leading publicly-traded marketplace lenders with a monthly stock gain of 12.52% and the UK Ranger Direct Lending Fund continuing to lead among UK listed funds with a monthly gain of 6.46%. Source

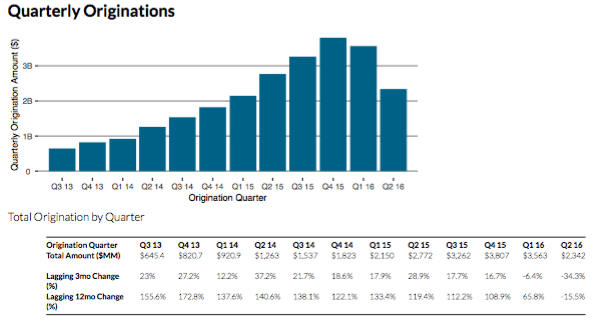

[Editor’s note: This is a guest post from Matt Burton, CEO and Co-Founder of Orchard.] The past nine months have...

Out of all the service providers in the marketplace lending industry Orchard has the broadest set of data on online...

·

[Editor’s note: This is a guest post from Jeremy Todd, Head of West Coast Sales at Orchard Platform. Orchard Platform...

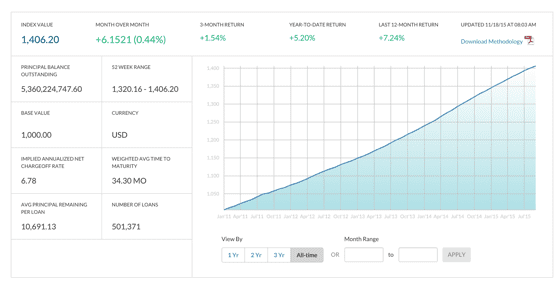

Orchard discusses the November 4 week's industry activities, highlighting banks' increasing interest in online lending and fintech in its weekly snapshot; the Orchard Index, which measures aggregate US P2P/MPL consumer loan performance, reported a monthly gain of 0.24%; Yirendai led gains in publicly traded companies with a monthly return of 11.29%; Ranger Direct Lending continued to lead gains in UK publicly traded funds with a monthly gain of 6.65%; the snapshot features Earnest's recently transacted securitization and reports the most recent securitization transacted by Lendmark Funding Trust. Source

OnDeck has partnered with institutional data consultant, Orchard, to provide data reporting for institutional investors on its platform; OnDeck is a small business lender with significant investment from institutional investors; through the partnership Orchard will manage the loan reporting for OnDeck's institutional investors and provide investors with access to investor dashboards, portfolio benchmarking, automated daily holdings reports and a variety of customized reporting options held within the Orchard for Originators data system. Source

Orchard, who specializes in connecting originators with investors today announced the Orchard Data Partner program. Orchard has tracked originators on...

Today, Orchard announced that their Orchard US Consumer Marketplace Lending Index will be distributed on the Bloomberg Professional Service. The index measures the...

·

[Editor’s note: This is a guest post from David Snitkof, Chief Product Officer & Co-Founder of Orchard Platform. Orchard Platform is...