In this week’s PeerIQ Weekly Industry Update they cover the cover a small rise in retail sales from Q4 to Q1; banks have had a strong earnings season, boosted in part by the cut in the corporate tax rate; Frank Rotman of QED provides insight on the path for the evolution of banking with his paper:The Copernican Revolution in Banking; they also provide highlights from their recent securitization tracker. Source.

This week’s PeerIQ Industry Update covers earnings reports from Citi, JPM and Wells Fargo, a review of Lendit Fintech USA 2018 and the latest version of the PeerIQ Valuation Report. Source.

This week’s PeerIQ Industry Update covers the great jobs report as nonfarm payrolls rose by 313,000 in February which caused the Nasdaq to hit an all-time high; CommonBond saw their first AAA rating by Moody’s and KBRA rated the senior bonds for OneMain’s latest deal at AAA, AA and A; PeerIQ also took a deep dive into the recent Amazon checking account news; they cover the benefits of the partnership, the significance of the deal and who might be next to enter the space. Source.

Online lending data and analytics platform PeerIQ announced their latest offering, a consumer credit suite backed by TransUnion data; the suite includes TransUnion’s depersonalized consumer credit data from the year 2000 to present day; users of the suite can see credit trends, vintage analysis, benchmarking analysis and more. Source.

In this week’s PeerIQ Industry Update they cover the recent rebound of equity markets after a volatile few weeks, regulatory news and a deep dive on fintech M&A; OnDeck announced they had reached GAAP profitability and it was reported that SoFi missed their internal targets; PeerIQ takes a deep dive on why banks should buy online lenders; some of the key reasons inclined ROE potential for the banks and to avoid potentially losing market share to big tech firms who might enter the space in the next few years. Source.

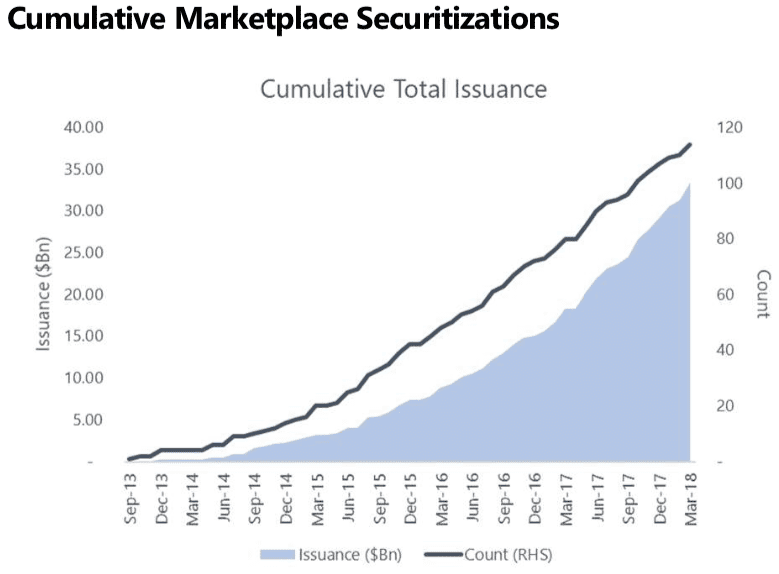

Securitization continues to grow for the marketplace lending sector. As they do at this time every quarter PeerIQ released their...

This week’s PeerIQ Industry Update covers the upwards revision of U.S. GDP growth to 2.9 percent from 2.5 percent; they provide a sneak peek into the PeerIQ Credit Facility Management Suite; Prosper announced 2017 results, former Avant founder John Sun raised $15mn for a new startup and the Arizona AG helped start the first fintech sandbox in a U.S. state in Arizona; Citi is building out their mobile app as the push by incumbent banks into digital becomes bigger. Source.

In this week’s PeerIQ Industry Update they cover the rising volatility in credit markets and the recent Q4 economic numbers; while at SFIG in Vegas PeerIQ shared comments from investors which show a lot of optimism and demand for MPL; they also talk about their recent product offerings and the continued push by banks to work with fintechs. Source.

In this week’s PeerIQ Industry Update they cover the latest minutes from the FOMC meeting, the new NY Fed report on mortgage lending and Lending Club’s earnings report; the FOMC is on track to raise rates 3 times in 2018 and the new rates could affect ABS pricing; the NY Fed report on the role of technology on mortgage lending said fintech lenders are reducing processing times by 20 percent and default rates by 25 percent; Lending Club reported record revenue and a net loss, their stock dropped 18 percent on the news; PeerIQ also gives a report on their recent partnership with Cross River Bank. Source.

The partnership will allow community banks and other loan purchasers to access the online lending space; it will leverage the Cross River’s expertise in capital, technology and regulatory compliance with PeerIQ’s expertise in data analytics and risk management. Geoffrey Kott, head of finance and strategy at Cross River Bank stated, “PeerIQ’s risk management platform — with its leading loan-level analytics and monitoring capabilities, credit facility management toolkit, and full integration of TransUnion data — will both augment our internal capabilities and provide best-in-class loan-level monitoring tools for our clients and partners.”; Cross River Bank currently works with many big names in fintech, including more than 15 online lenders. Source