This week’s PeerIQ Industry Update covered the strong job growth reported and the chances of a rate hike in March; Marcus made key hires in an effort to launch a credit card as it builds out their consumer banking businesses; Marlette completed its largest securitization for $464mn and saw the senior tranches of the deal rated AA by Kroll; PeerIQ also highlighted key points from testimony by Nat Hoopes of the Marketplace Lending Association when he testified before the House Financial Services Committee. Source.

In this week’s PeerIQ Weekly Update the company covers the recent spate of bank earning reports, securitization news and issues another round of hiring updates; banks have seen a continued drop in fixed income and commodities trading revenue, picking up the slack has been lending and wealth management; Citigroup and Morgan Stanley had strong reports while Goldman Sachs and American Express missed the mark; SoFi is issuing a $720mn securitization deal, Moody’s rated the A classes AAA; PeerIQ also lists five new hires stemming from the $12mn round last summer. Source.

The easiest way to get insight into the marketplace lending securitization market is through PeerIQ’s quarterly reports. It feels like...

In PeerIQ’s Weekly Industry Update they cover job growth numbers, the Fed’s planned rate rises and more fintech related stories that ended 2017; OneMain Financial received backing from Apollo Global Management and Värde Partners; GreenSky and MoneyLion completed fundraising’s; new regulation news coming out of Indiana that would cap the personal loan interest rates. Source.

This weeks PeerIQ Industry Update looks at strong job growth despite the hurricanes, Lending Club’s investor day and the latest in securitization; Rep. Patrick McHenry accused the Cleveland Fed, who recently had their p2p lending report retracted, of trying to block the bill entitled Protecting Consumers Access to Credit Act; Lending Club’s first Investor day was not received well by the markets as their stock hit all time lows; PeerIQ reviews the full scope of the investor day including positioning & strategy, product & financial innovation, funding mix, investor returns and stress tests. Source.

This week’s PeerIQ Industry Update covers 4th quarter GDP news, another round of bank earnings, the new SoFi CEO, fintech fundraising’s and the latest securitization trends; the new SoFi CEO was accepted positively across the market as the company looks to expand products in coming quarters; SoFi and Lending Club are looking at a busy quarter on securitization issuance and PeerIQ reviews their most recent deals; Streetshares secured a $23mn series B round led by Rotunda Capital; PeerIQ also took a deep dive into the key points of the recent letter CFPB Director Mulvaney circulated to staff about his vision for the bureau. Source.

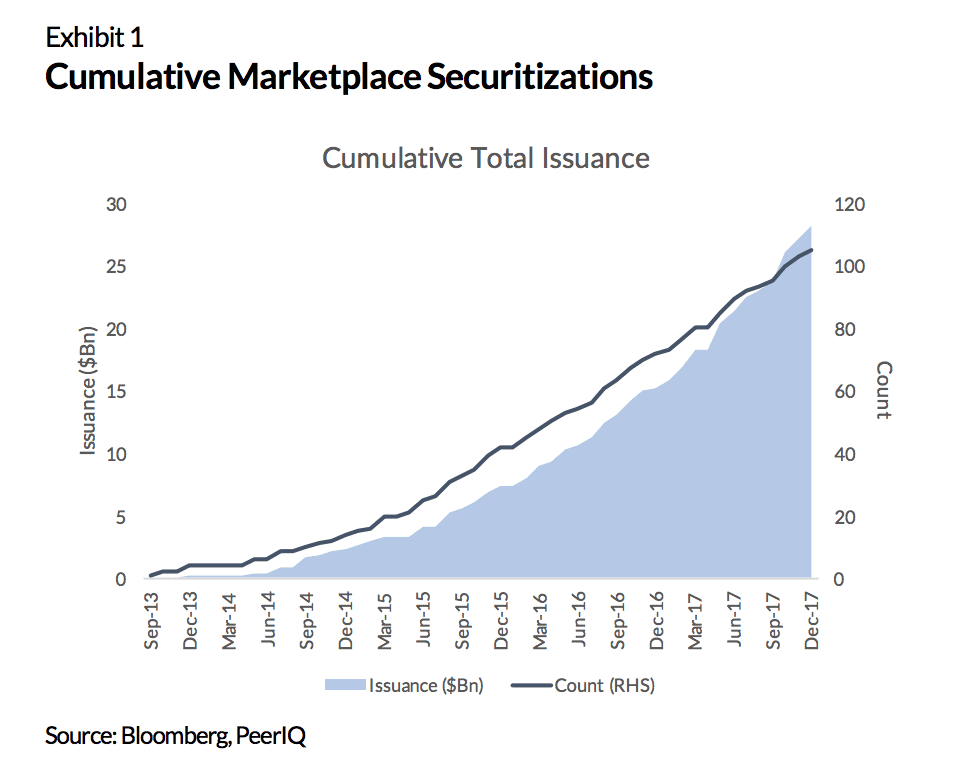

Cumulative issuance for marketplace lending securitization now totals $28.2 billion across 106 deals; Q4 2017 issuance totaled $4.4 billion which was another record quarter; SoFi issued the largest consumer and student lending deals ever; PeerIQ shares other highlights in their quarterly report. Source

In this week’s PeerIQ Industry Update they look at the record levels of consumer debt, some regulatory changes, new securitizations and give an update on recent hirings; consumer credit is now at an all time high surpassing $1tn, though per capita levels remain below peak; the Trump administration is looking to revise the Community Reinvestment Act rules to include small business loans; Marlette’s newest securitization, MFT 2018-1, consists of loans originated by Cross River bank for over $390mn and it has received ratings from Kroll; PeerIQ also announced the hiring of 6 new employees as the company continues to grow. Source.

This week’s PeerIQ Weekly Industry Update covers the Fed raising rates by 25 bps, Affirm’s big fundraising and securitization news; PNC announced their new lending pro cuts through their mobile wallet and anticipate it will outperform branch loans; Equifax completed their first Securitization, a $200mn deal backed by lender fee revenues; PeerIQ does a deep analysis on the Sharpe Ratio which helps to gauge risk-adjusted returns. Source.

This weeks PeerIQ Weekly Industry Update covers the power struggle at the CFPB and Lending Club’s new pass through security transaction; a federal judge sided with the Trump administration in the CFPB spat and allowed for Mr. Mulvaney to run the agency for now; Lending Club completed a first of it’s kind deal and in turn will help them to expand the market, lower financing costs, address secondary market liquidity and allows valuation agents to calibrate pricing; PeerIQ also took a deep dive on mortgage delinquencies during the 2008 financial crisis. Source.