In the space of a week, Petal and newly-formed spin-off, Prism Data have made two significant announcements, super charging open banking.

When immigrants come to the U.S. they are starting at zero when it comes to a credit profile and that...

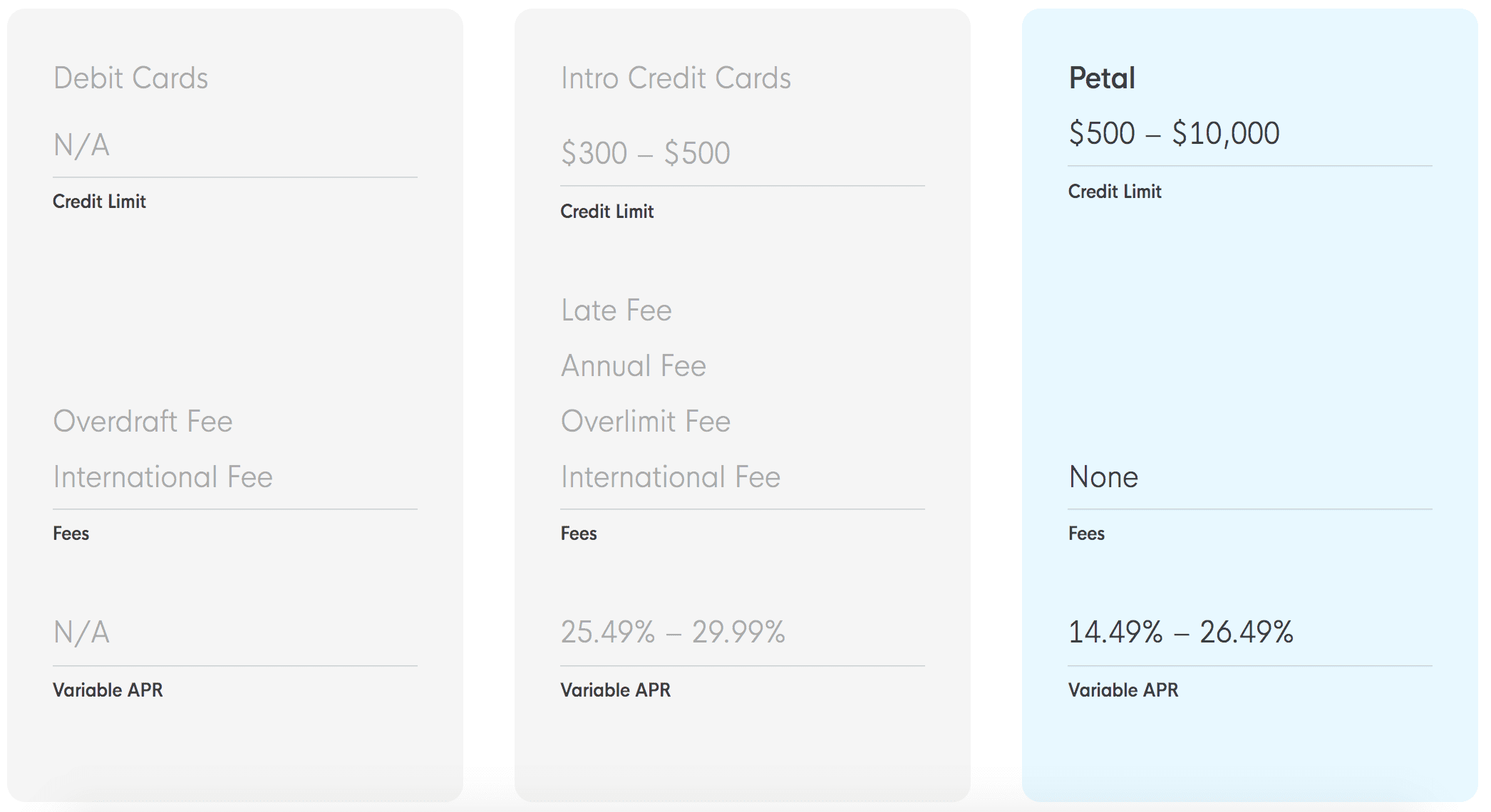

Petal’s new credit card will focus on the 65 million people who lack credit history for a traditional card; they have been working for three years on their product which uses AI to predict a consumer’s creditworthiness; the company raised a $3.6 million seed round last September and followed with a $13 million Series A in January of 2018; the partnership with WebBank will allow Petal to make the card available nationwide which they anticipate will happen over the next few months. Source

Petal uses information beyond credit scores like earnings, spending and savings to identify people who are a good fit for a credit card; users can then use the Petal card to build their credit history; the company raised $13 million led by Valar Ventures. Source

In an engaging LendIt Fintech Digital session yesterday several leading consumer lenders discussed how they have adapted to the crisis...

A majority of fintech companies today focus on providing faster and cheaper financial products to already well-served Americans. While this...

Immigrants face challenges when it comes to accessing credit when they come to the US; while in their home country they may have established a solid credit history, they now have to start from scratch; several fintech companies tackling this problem include Nova Credit, CreditStacks and Petal. Source