LendIt Fintech held the 5th annual industry awards to celebrate the top fintech influencers and innovators.

In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

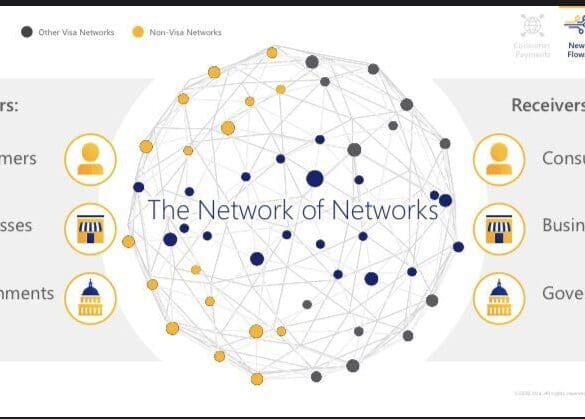

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

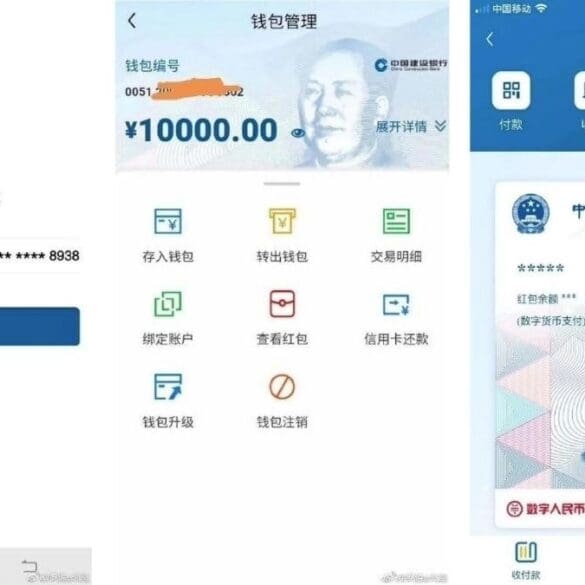

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

The firm is calling it the Plaid Portal and not explicitly tying the launch with a privacy settlement the firm reached on Friday, but the timing is close enough to call.

Instead of joining a major payments provider, Plaid aims to disrupt the Visa, Mastercard, and Amex payment empire. Partners like Square, Dwolla, and new arrivals to the Plaid ecosystem Checkout.com and Marqeta are members of the new program, building payment capabilities for the new age of fintech.

In this video conversation we feature a roundtable by The Defiant exploring how and if the gap between Fintech and DeFi will be bridged.

DeFi Panelists

Lex Sokolin, head economist at ConsenSys

Santiago Roel Santos, angel investor

Spencer Noon, Investor at Variant

Vance Spencer, co founder at Framework Ventures

Fintech Panelists

Keith Grose, head of Plaid international

Nik Milanovi?, founder of This Week in Fintech

Simon Taylor, co-founder of 11:FS

Bruno Werneck, Business & Corporate Development at Plaid

Moderator

Camila Russo, Founder of The Defiant

As the sun sets on 2020 and we look back at this past year nearly everything is viewed through the...

[Editor’s note: This is a guest post from Ryan Weeks, formerly with Dow Jones and AltFi, covering fintech. This is...