The offering streamlines Web3 business' ability to maintain KYC compliance in the US as they navigate the regulatory landscape.

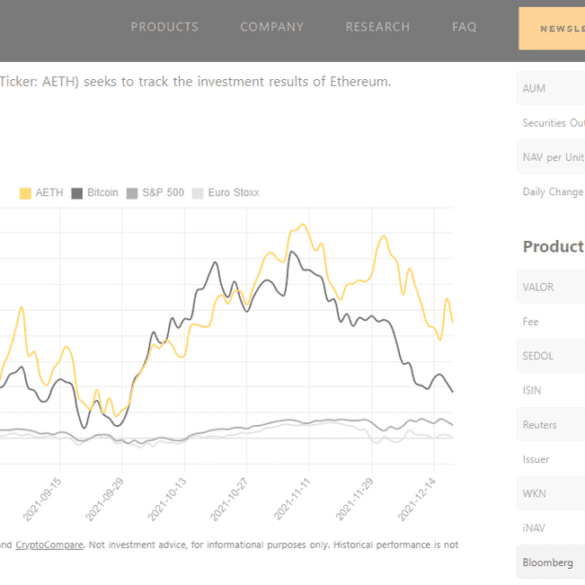

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

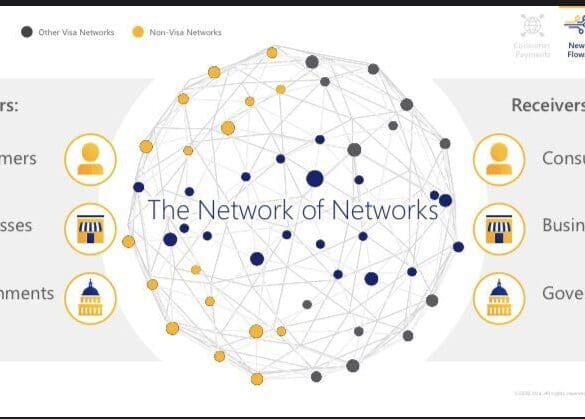

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

Nubank is doubling its bets in crypto technology. The neobank announced plans to develop its virtual token to drive a loyalty program.

digital transformationEmbedded Financeenterprise blockchainexchanges / cap mktsmega banksneobankOpen Bankingopen source

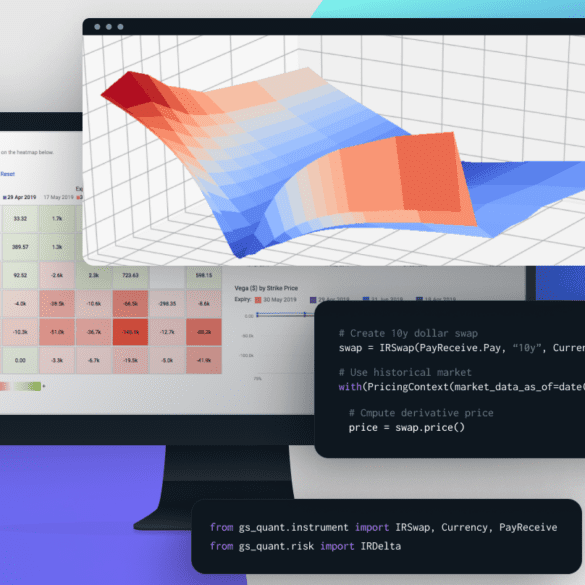

·In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.