Crowdfund Insider talks with Ron Suber about Prosper and marketplace lending in 2016; in 2016 the firm reported decreased investment and transaction fee revenue which led to a number of new initiatives and changes; in his comments Ron Suber cited the importance of being adaptable to change; he also talked about the investment opportunity from institutional investors and the importance of securitization and a secondary market; for 2017 he expects rapid changes for the industry to continue and hopes that as the industry evolves it will result in more opportunities for borrowers, online lending platforms and the ecosystem. Source

Many of us in this industry will be glad to see the last of 2016. It has been a difficult...

Estimated return on loan production in November 2016 was 6.58%, which is down from the previous three months; Prosper attributes its revised pricing and credit market trends overall to the month's weaker performance; the average FICO score in November was 714.2 which is approximately 10 points above the FICO scores in 2015 vintages; cumulative charge-offs are trending higher in 2015 and 2016 than 2013 and 2014; higher pricing is also a factor potentially affecting prepayment rates which are higher for loans originated in 2016. Source

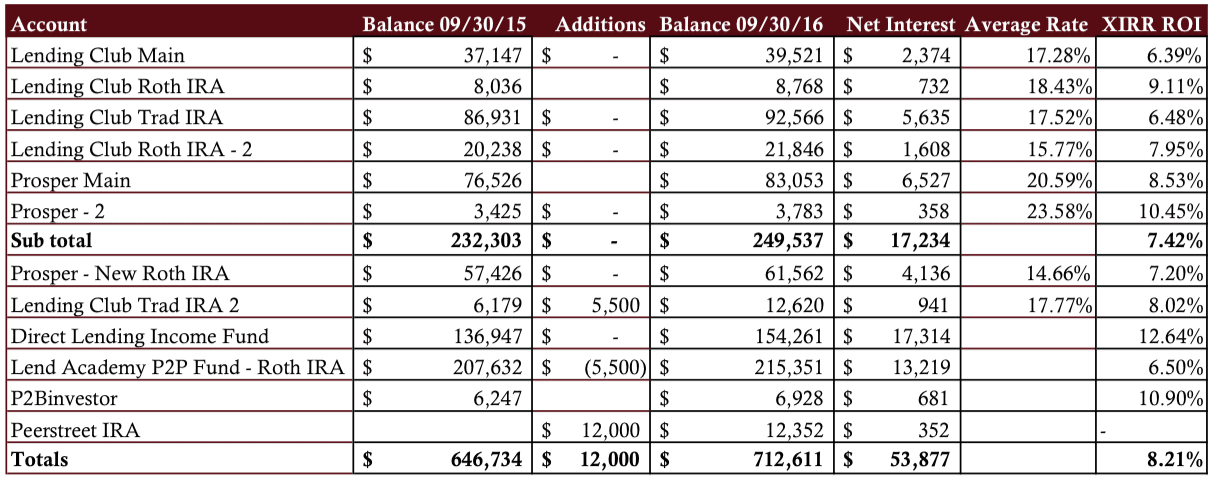

Every quarter I take some time to share how my marketplace lending investments have been doing. I open the kimono...

We often get emails from readers asking about the current state of investing with Lending Club or Prosper. Many investors...

NSR Invest, which allows Lending Club and Prosper investors to analyze loan data and direct investments, has made Prosper's Q3 data available; users can now backtest the most recent Prosper loan data and view trends of older vintages yet to reach maturity; originations for Q3 2016 totaled $311 million. Source

In a letter to investors, Prosper has announced they are releasing their seventh generation credit model (PMI7) around December 20, 2016; Prosper also announced they are changing their credit bureau from Experian to TransUnion; according to Prosper, "Using TransUnion will allow us to leverage trended historical data on borrowers and make better underwriting decisions within the new credit model."; Prosper's rating system on loans from AA-HR will remain the same.

Prosper released its October 2016 performance report with the month's estimated return of 7.12% just below the estimate of 7.17% for the third quarter; in October, vintage prepayment rates continued to trend higher; delinquencies and loss patterns since 2013 are below levels in 2012; cumulative gross charge-offs appear to be a factor trending higher; average FICO of the portfolio was 714.1 in October. Source

Today, the Wall Street Journal broke the story that Prosper CEO Aaron Vermut is stepping down as CEO. This afternoon Prosper...