Prosper is lowering rates for higher credit quality borrowers and increasing rates in the lower credit quality segments; borrowers with loan ratings AA through C will see a rate decrease of as much as 79 basis points while borrower ratings D through HR could see an increase of as much as 74 basis points; in total, across all ratings, rates will be lower by approximately 39 basis points; Prosper says the rate changes are a result of the credit market environment, interest rate expectations and competition for consumer loans. Source

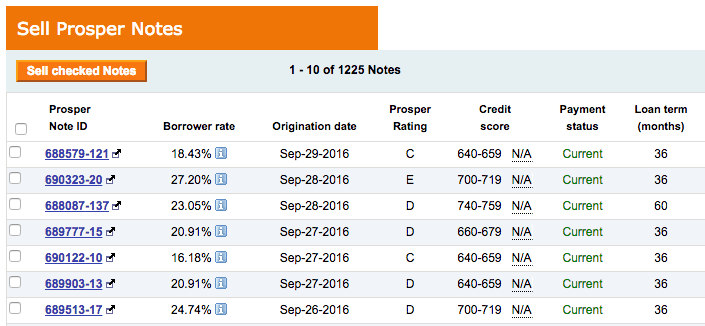

In an email sent out to investors earlier today Prosper announced they will be closing down their secondary market on...

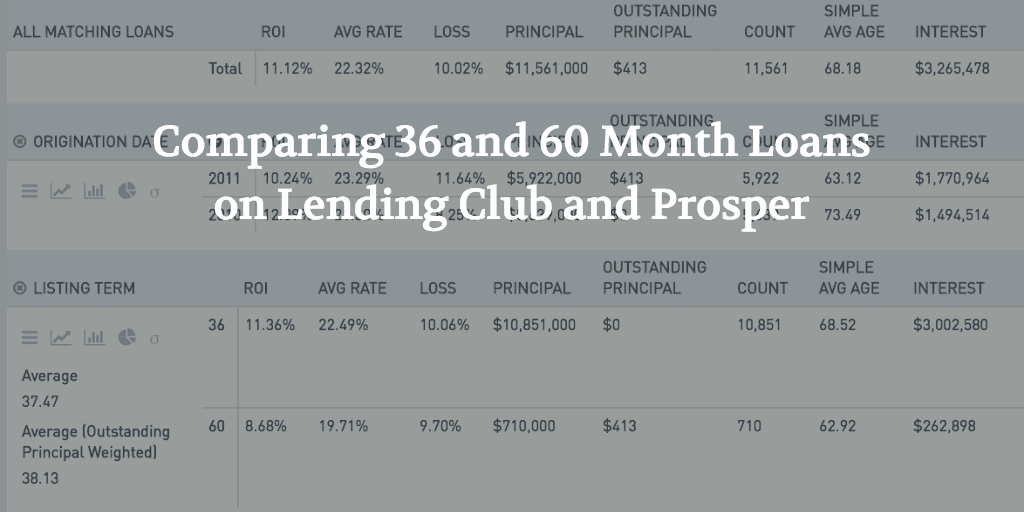

A question investors often ask when investing in Lending Club and Prosper loans is whether they should invest in 36 month...

The Wall Street Journal is reporting today on a potential $5 billion investment into Prosper loans. This deal has not...

I first became aware of CreditEase back in June 2013 at the inaugural LendIt conference in New York. We met...

There have been several groups formed in the online lending industry but the latest one doesn’t focus on a voice...

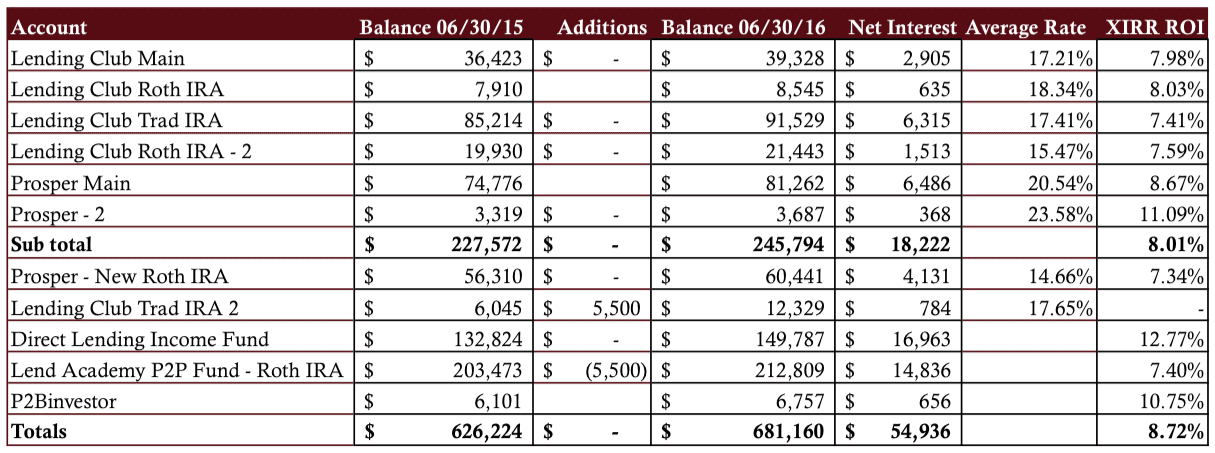

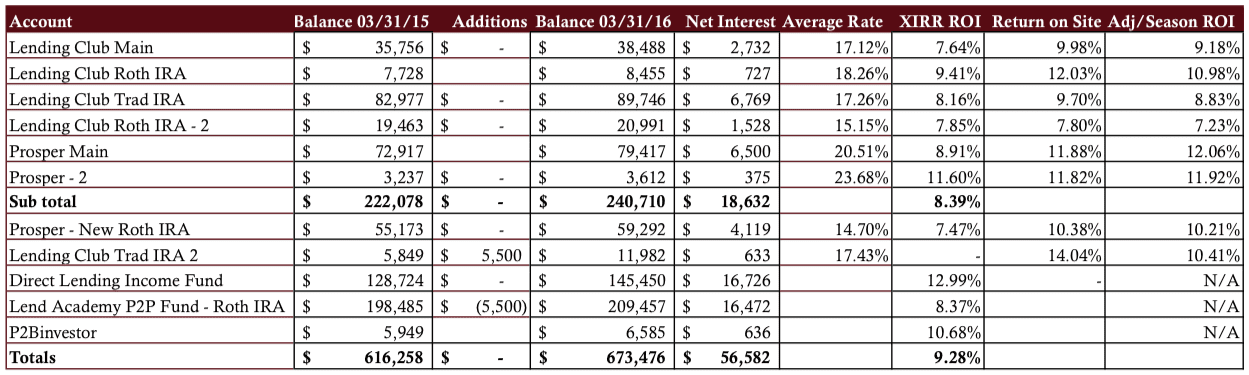

Sharing the details of my returns is one of the regular features on Lend Academy and one that I am quite passionate...

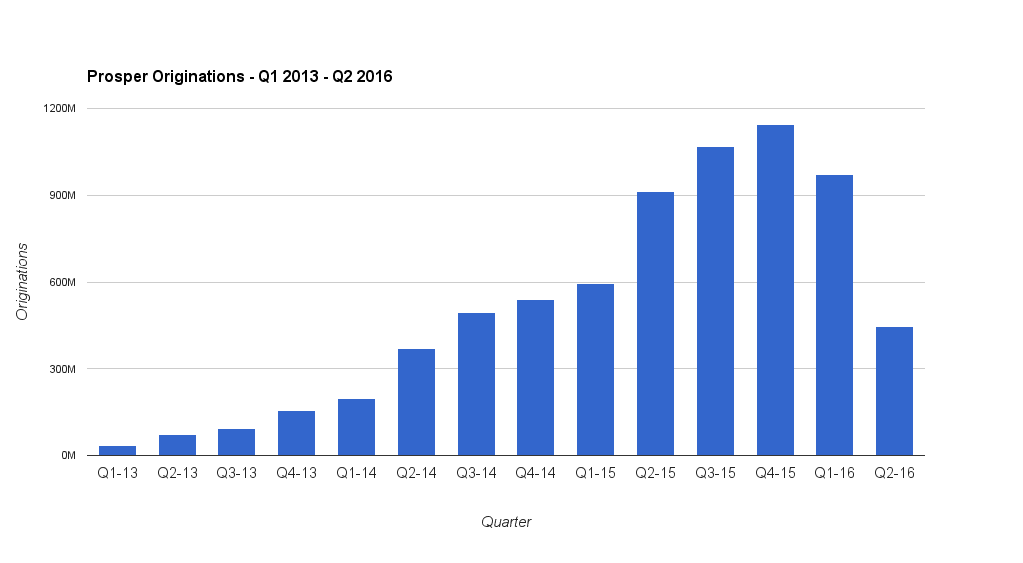

Two of the leading marketplace lending platforms reported some more bad news this week as the industry continues to struggle...

Today, Prosper officially announced their new investor user interface. The new modern site now ties in with the new Prosper...

We have had quite a month of news here in the P2P lending industry. But now I want to return...