This week's PeerIQ update focused on news from the FOMC, a $50mn Prosper fundraise led by FinEx and highlights from ABS East; they also provide a recent update on securitization deals, trends in personal loan originations and a bank partnership between JP Morgan Chase and Bill.com. Source.

Both Lending Club and Prosper have announced several programs to help borrowers affected by Hurricane Harvey; Lend Academy shares an email to Lending Club investors which states approximately 30,000 live in the affected areas; Lending Club has made changes around collections calls, late fees, credit bureau reporting and hardship plans; Prosper has taken similar actions by waiving late and NSF fees as well as adjusting payment schedules. Source

Prosper tightened its credit underwriting in July resulting in a shift toward lower risk loans; the changes caused a total portfolio coupon decrease of 45 basis points and a return estimate decrease of 26 basis points; reported lower charge-off levels from 2016H2 loans and higher delinquencies from loans issued in 2016 and 2017; C-rated loans accounted for the greatest portion of the total portfolio at 31.54%; estimated weighted average return for the month was 7.75%. Source

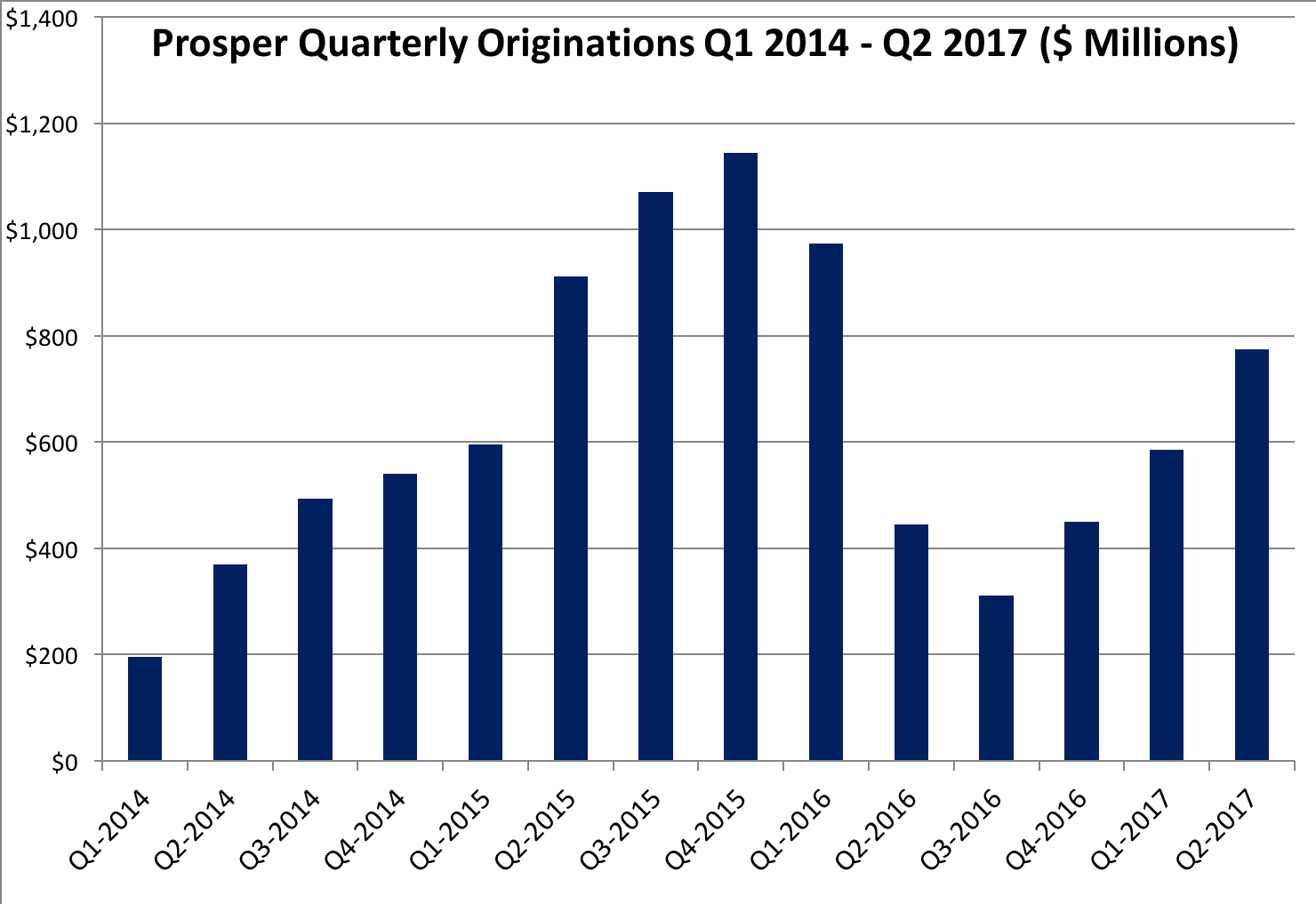

Prosper's originations were $775 million in the second quarter of 2017, up from $586 million in the first quarter; adjusted EBITDA was $6.7 million in the second quarter and the company was cash flow positive; Prosper had their first profitable quarter in Q3 of 2014 before growing significantly and subsequently falling back into the red; whole loan sales represented 94% of total volume in Q2; Prosper has originated a total of $9.7 billion in loans; Prosper also announced closing a $500 million securitization; PMIT 2017-2 was rated by Kroll Bond Rating Agency, Inc. and Fitch Ratings with the Class A pool receiving an A rating. Source

Prosper is in talks with Chinese conglomerate Linca to sell an approximately 10% stake in the company; according to the source, Linca would invest $50 million in Prosper at a valuation of about $550 million, reducing Prosper's value from approximately $2 billion reported in 2015; plans for its recent $5 billion investment in loans on the platform from a consortium of investors continues and this new deal is reportedly expected to help provide capital for future investments. Source

Last week Prosper closed their Series G, raising $50 million from an investment fund co-managed by FinEx Asia and LPG Capital based in Hong Kong; sources say the post money valuation was $550 million, approximately a 70% drop from their high in 2015; Peter Renton reflects on the investment and the current state of the market. Source

Hurricane Harvey has already had a tremendous impact on Texas. Part of the impact is the financial stress it has...

Consumer lenders Lending Club and Prosper are reporting growth in originations; for the second quarter Lending Club loan originations reached $2.1473 billion, increasing 10% from the previous quarter and the second quarter of 2016; Prosper originated $774.7 million worth of loans in the second quarter of 2017, an increase from $586 million in Q1 and $445 million in the second quarter of 2016; both companies had high Q1 2016 originations which has kept first half 2017 totals down in comparison to 2016. Source

·

Prosper announced their second quarter numbers today and the results are quite promising. Even though Prosper is a private company...

It was back in September of 2015 when Prosper announced they had purchased the personal finance analytics company called BillGuard...