Lend Academy's Peter Renton provides insight on his marketplace lending investment strategies for Lending Club and Prosper loans; outlines the options available for investing and highlights best performing loan grades; reports details of loan filters he is using across his eight accounts. Source

Global Debt Registry (GDR) has been steadily growing its business now announcing that Prosper will join the firm's verification network; by partnering with GDR, Prosper can enhance the reporting for its institutional investors; according to John Goldston, director of capital markets at Prosper, "GDR's eValidation and eVerify asset certainty tools fit easily into our existing data structures and processes, allowing our investors to seamlessly access GDR's enhanced verification and loan-level diligence services." Source

The April 18, 2017 tax deadline also marks your last chance to fund a new traditional IRA or Roth IRA for 2016. Both...

Lend Academy provides details on the tax documents you will receive as an investor in Lending Club or Prosper loans; most investors will receive a 1099-OID which details taxable interest income from investing; other forms may also include a 1099-MISC or a 1099-B; income earned from P2P loan investing is taxed as ordinary income; Lend Academy also outlines details on capital losses and capital loss carryovers which can vary by state. Source

Prosper filed its annual earnings report with the Securities and Exchange Commission showing an annual loss in 2016 of $118.7 million from revenue of $132.9 million; the loss compares to an annual loss of $26 million for 2015; 2016 was a challenging year for the industry overall; Prosper attributes the losses to lower loan volumes and higher restructuring and legal costs; in February, Prosper reported a $5 billion deal with a consortium of investors committing to invest in Prosper's loans over the next two years, which has helped to give the firm a much more positive outlook for 2017. Source

In the early days of Lend Academy I regularly wrote about my investment strategy for Lending Club and Prosper. I discussed the wonders of...

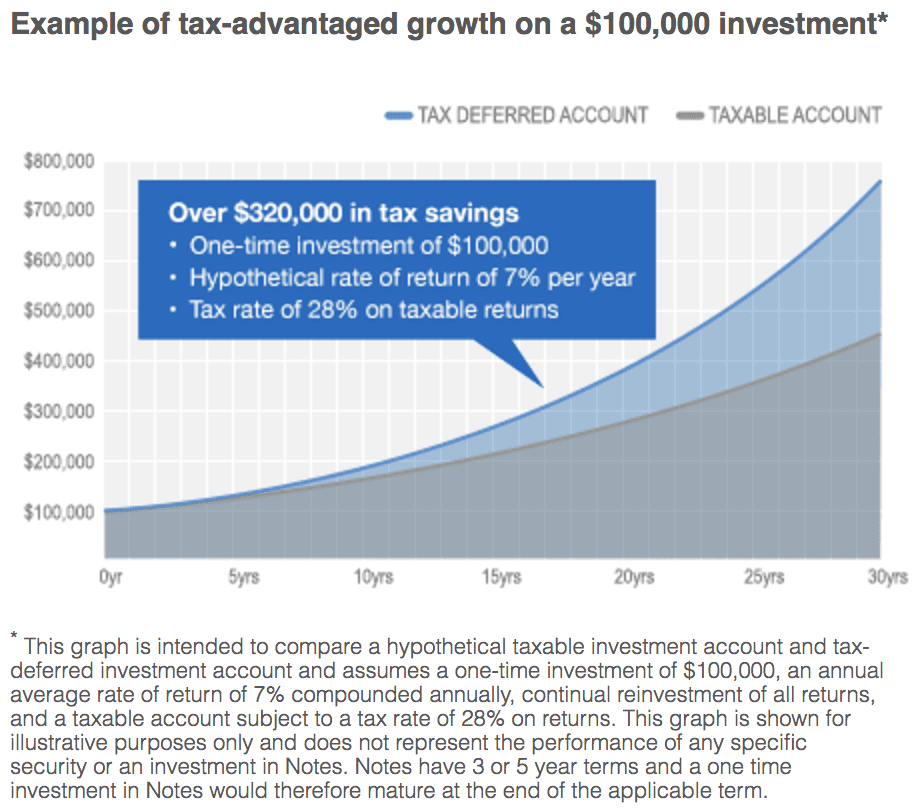

Lending Club and Prosper allow for tax efficient investing on their platforms through an IRA; Lend Academy provides details on opening an IRA with Lending Club or Prosper and explains why investing in P2P lending is best done through an IRA. Source

Ron Suber discussed the challenges that online fraud can present to marketplace lenders in his keynote speech at the Fintech Fraud Summit last week in San Francisco; to mitigate fraud, companies must have a comprehensive risk and compliance system that protects it from attacks and fraudulent loans; Ron Suber outlined Prosper's risk and compliance approach in his presentation providing an example for marketplace lenders seeking solutions for mitigating and managing fraud. Source

[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post shares how Lending Club...

AltFi Data is the leading public provider of data for the marketplace lending industry; its data platform, AltFi Data Analytics, aggregates data from originators in the UK, Europe and the US; AltFi Data manages indices and publishes analytics reports with support from the data platform; the addition of data from Prosper will make the platform's reporting more robust for the industry. Source