Prosper has announced it will be increasing rates on its high-quality loans and lowering the rate on its HR rated loans; as of March 2 rates will increase on loans rated AA, A and B with an increase of 60 bps, 50 bps and 20 bps respectively; interest rates on HR rated loans will decrease by 10 bps. Source

It was almost seven months ago when the news first came out about a massive deal that was in the works...

In January, Prosper began using its new PMI7 credit underwriting model; Prosper expects PMI7 to help improve returns and credit scoring metrics; the estimated return on loans issued for January is 7.86%; post-charge off recoveries have been higher than estimated which is expected to increase IRR calculations; delinquencies and pre-payments are also improving; the average coupon increased 300 bps in January to 15.99% as PMI7 caused an increase in higher risk loans. Source

Prosper has reported the loss of another company executive a few months after the resignation of its former CEO Aaron Vermut; Eric Thaller, executive vice president of capital markets, has left the firm to join Sunbit, a consumer lending startup offering point of sale credit solutions for retail businesses; Thaller was a lead advocate for institutional investment in marketplace loans and directed the firm's institutional investment business. Source

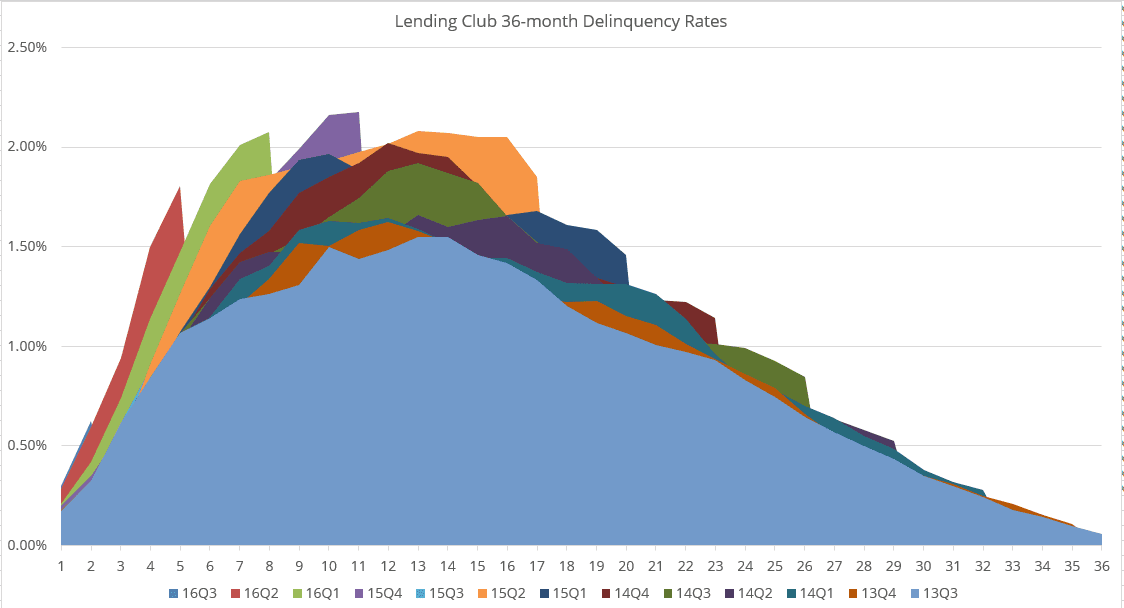

Lend Academy provides details on how marketplace loans are performing at Lending Club and Prosper; delinquency rates have been increasing since the third quarter of 2014; less risky loan grades have continued to report the best performance; lower quality loans have suffered increased degradation specifically since the third quarter of 2014; Prosper has made fewer interest rate changes than Lending Club and it seems its higher risk loans are performing slightly better; Lending Club announced additional changes to the platform on January 18th. Source

Prosper has announced a funding deal which has been in development since August; the firm has received an investment commitment for $5 billion over the next two years from a consortium of investors including affiliates of New Residential Investment Corp., Jefferies Group LLC, Third Point LLC and an entity of which Soros Fund Management LLC is the principal investment manager; the consortium is also being offered an equity stake which could account for as much as 35% ownership in the company and is expected to help promote a long term business relationship; the committed investment will represent a substantial increase for the firm which is likely to report approximately $2.2 billion in loan originations for 2016. Source

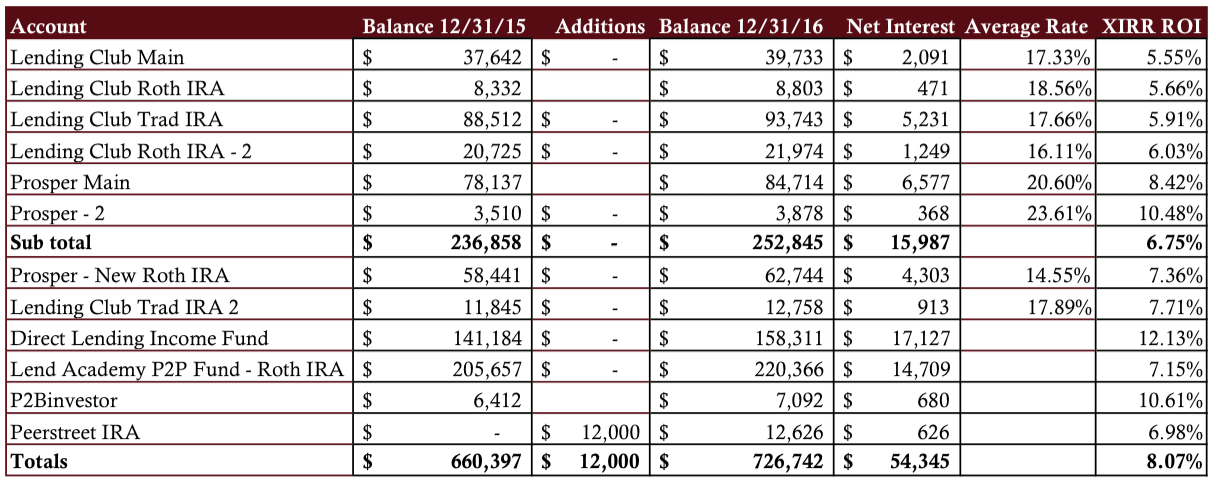

Regular readers know that this is one the most popular features on Lend Academy. I have been sharing my detailed quarterly...

Today, Prosper appointed Usama Ashraf as its new CFO; Ashraf will also oversee the capital markets side of the business to bring in new investors; Ashraf has more than 18 years experience in corporate finance and capital markets; recent positions include being the deputy chief financial officer and treasurer at Annaly Capital Management and corporate treasurer at USAA; David Kimball, Prosper's CEO stated: "We're thrilled to have someone with Usama's experience and track record in finance and global capital markets join our team. Usama will be instrumental in bringing new institutional investors onto the Prosper platform, including banks, as we continue to grow the platform in 2017." Source

Estimated return for December 2016 production is 6.45%; PMI7, Prosper's underwriting model, was put in place late December, 2016; models are updated every 12 to 18 months; average FICO was higher than lows in 2015 and 2016 but is expected to decrease with an increase in lower grade loans as a result of the new credit risk model; prepayment rates increased and delinquency rates were lower; cumulative gross charge offs have increased but are expected to trend lower. Source

In part one of this series we explored the interest rate movements at Lending Club over the past year. In this post...