In this conversation, I talk with Matt Low of QPQ.io and InveniumX Limited, about digital collectibles, crypto art, NFTs, and all the fun decentralized things going on. The market is annualizing to $200 million in sales volume based on CryptoArt.io, and $250 million in asset issuance according to NonFungible.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

A few delicious morsels for us today, connecting ideas between the automation of the institutional art world, and the rise of non-fungible token art. We are surprised by how things are clicking.

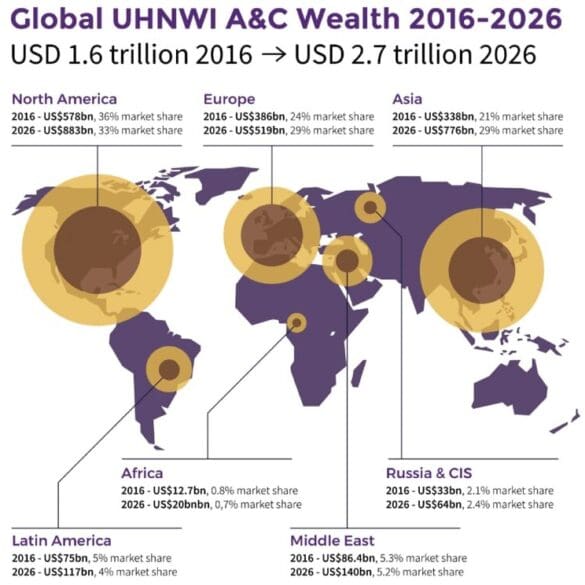

We caught up recently with Lori Hotz of Lobus. Lori used to work in the wealth and investment management businesses of Wall Street (Lehman, Lazard) and comes to art with a background of asset allocation and investment assets. One core narrative in wealth management has of course been roboadvisors and digital wealth, and the automation of the financial advisor process. Whether you are doing client experience, CRM, financial planning, trading, or performance reporting, there are now lots of platforms for everyone from mass-retail to ultra-high-net-worth and family office advisors.