Online real estate lending platform PeerStreet has partnered with Wealthfront; PeerStreet will integrate with Wealthfront's Path offering; the integration has been facilitated by Quovo and will allow PeerStreet customers to view their PeerStreet investments holistically within their entire Wealthfront investment portfolio. Source

Last week I spent the week at MIPIM, the largest conference in world dedicated to real estate. The conference is...

CapitalRise has announced the launch of an innovative finance individual savings account (IFISA) offering its investors a tax free account for investing in the firm's real estate investments; investors can invest in the IFISA with a minimum of 1,000 British pounds ($1,223); the investment maximum for the current tax year is 15,240 British pounds ($18,632) and the maximum will increase to 20,000 British pounds ($24,451) in the following tax year; the platform offers a range of real estate loan property investments in the UK with tax-free returns of approximately 10% to 14% per year. Source

Last year we featured GROUNDFLOOR who was the first p2p lending firm to leverage Regulation A+ in Title IV in...

[Editor’s Note: This is a guest post from Ray Sturm, the Co-Founder and CEO of AlphaFlow, which helps investors build and...

For online platforms there is considerable cost to be able to accept retail dollars. This is one of the reasons that Lending...

Nested has reported an 8 million British pound ($10 million) fundraising from investors Passion Capital, GFC and Tim Bunting; the growing company is another example of proptech innovation in residential real estate; targeting the UK housing market, the company guarantees the sale of listed property within 90 days either to a new owner or by buying the property themselves. Source

After the government ordered regulators to step in, property developers are now finding it very hard to raise debt or equity financing for developments; regulatory bodies have been told to stop issuances on the Hong Kong stock market, the Hong Kong bond market and in the Chinese interbank bond market; this is recently after a similar freeze on the Shanghai Stock Exchange; the crackdown is also looking to curb peer-to-peer transactions related to down payments; outstanding mortgage loans are at their highest level ever, $2.4 trillion in the first half of 2016. Source

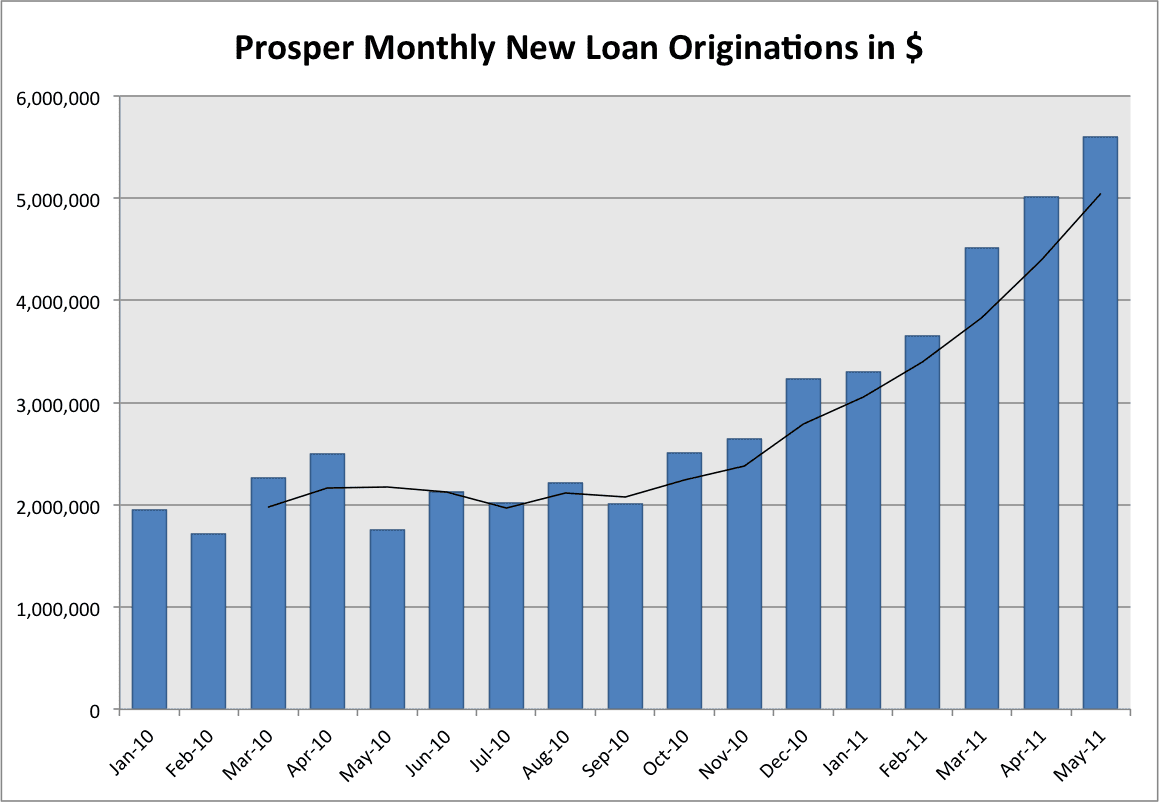

Last month SoFi quietly crossed $10 billion in total loans issued. A remarkable achievement for a company that is less...

·

[Editor’s note: This is a guest post from Prime Meridian Capital Management. Prime Meridian Capital Management is a Bronze Sponsor at LendIt USA...