One of the true pioneers of the fintech space joins us for the show today. This is someone who has...

There are still funding rounds getting done during the pandemic, evenly solidly up rounds; Renaud Laplanche’s Upgrade has just closed...

When Renaud Laplanche started Upgrade in 2017 there were high expectations that the fintech pioneer would be breaking new ground...

In his interview with AltFi, Laplanche reflects on his experience at LendingClub and how that has helped him shape his...

Business Insider interviewed Renaud Laplanche last week at LendIt Europe; on his exit from Lending Club, Laplanche stated, “It was very, very frustrating. I'm not commenting on the story, but the best way to actually understand what really happened is to read the filings. I think the press made it sound a lot worse, a lot more sensational, than it really was.”; he is taking what he learned from building Lending Club and applying it to his new company Upgrade; Laplanche stated that he hopes to launch a new product each year with possible expansion into mortgages, auto loans, credit cards, home equity and lines of credit. Source

Fresh off a new funding round that put Upgrade in unicorn status, CEO and Co-founder, Renaud Laplanche talked with Crowdfund...

In a wide ranging interview with Crowdfund Insider, Upgrade CEO and Co-founder Renaud Laplanche discusses what makes his company unique...

Last week there were significant developments in the legal troubles that have dogged both LendingClub and former CEO Renaud Laplanche...

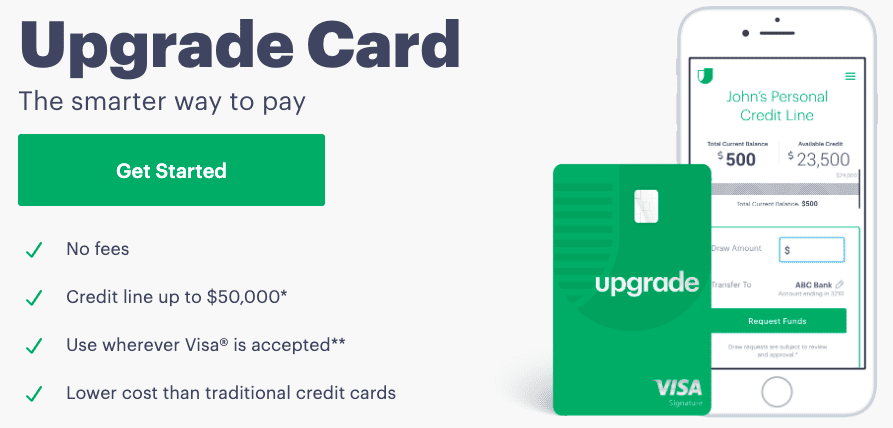

While the personal loan has been around for centuries and the credit card has been around for decades they have...

SuperMoney reviews the new US consumer lending platform founded by Renaud Laplanche; firm is an online lender focused on personal loans, also offering consumer credit monitoring and education for its customers with benefits for high quality borrowers; SuperMoney outlines the platform's underwriting standards, application process, and pros and cons versus competitors. Source