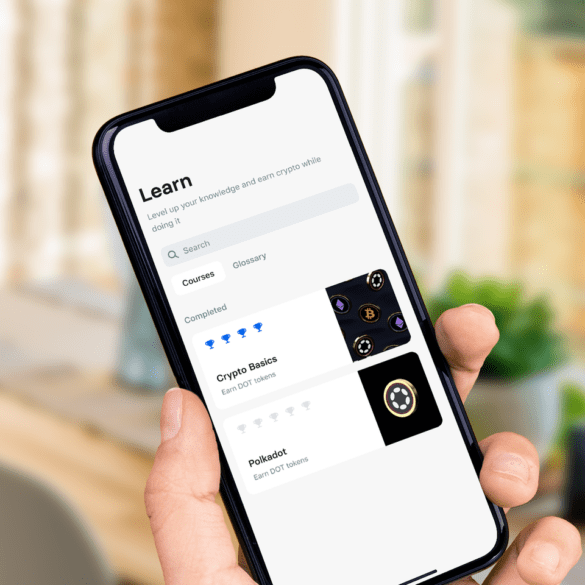

Crypto Basics covers how cryptocurrencies differ from fiat money, what a decentralized system is, how cryptography works, and the risks.

Revolut, one of the largest digital banks in the world, has announced plans to expand its business to Latin America’s largest markets.

It is unsurprising that the UK has embraced the financial market shift to fintech, but where do they stand on a global scale?

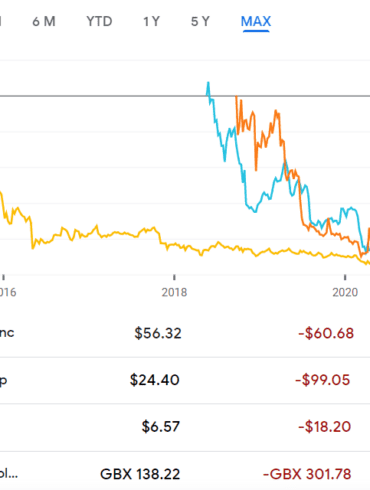

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

Global neobanks have focused on the regional ecosystem as the fintech sector gained decent size and scale in the past few years.

Fintechs lose 50% of new accounts within the first year, according to Digital Onboarding SVP Adam Westley: Money walks right out the door.

Many of these firms have aimed to go public in the vague "end of 2021/ early 2022/ when we have enough money" time frame while participating in increasingly rare-letter funding rounds.

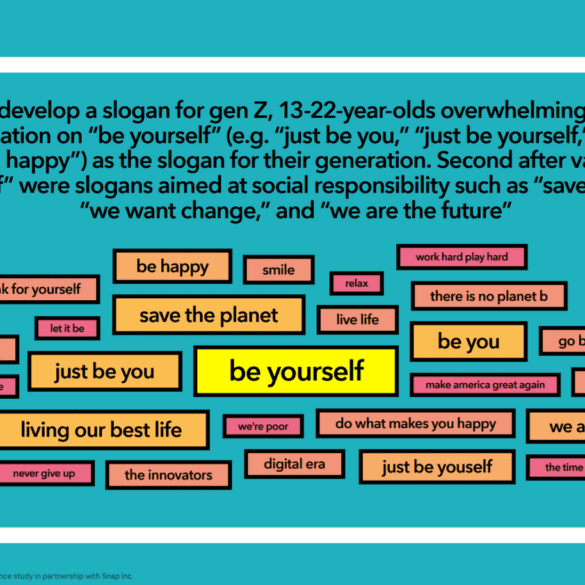

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.

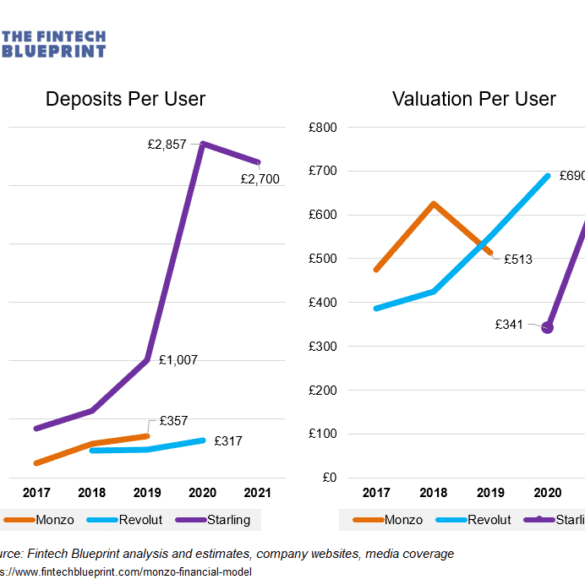

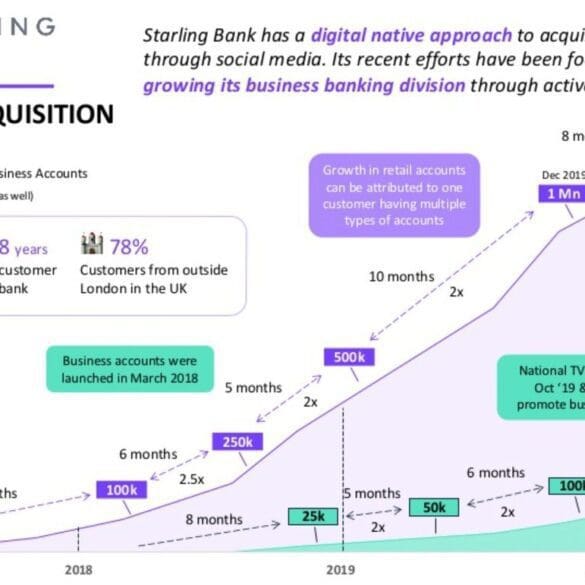

In this conversation, we talk with Anne Boden, the CEO of Starling Bank. Starling has just turned profitable, and reached several significant milestones in terms of 1.8 million clients, $4 billion in deposits, and $1.5 billion of lending.

That is quite meaningfully ahead of our model, and probably ahead of everyone’s model, of where neobanks would be in 2020. While COVID has accelerated the digital lifestyle, Anne credits deeper demographic, technology, and cultural insights and choices she has made in building Starling for success.