[Editor’s note: This is a guest post from Ryan Weeks, formerly with Dow Jones and AltFi, covering fintech. This is...

This week, we look at:

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

Here are the most read news stories from our daily newsletter today: The Clearing House On The Race for Real-Time...

UK fintech investment dropped 39 percent for the first half of 2020 to $1.84bn, down from $3bn in the first...

Clearbanc just launched a valuation tool that its cofounders are calling a credit score for startups. Here’s what entrepreneurs need...

Here are the most read news stories from our daily newsletter today: OCC chief expects SWIFT-like bank-to-blockchain connections in 3...

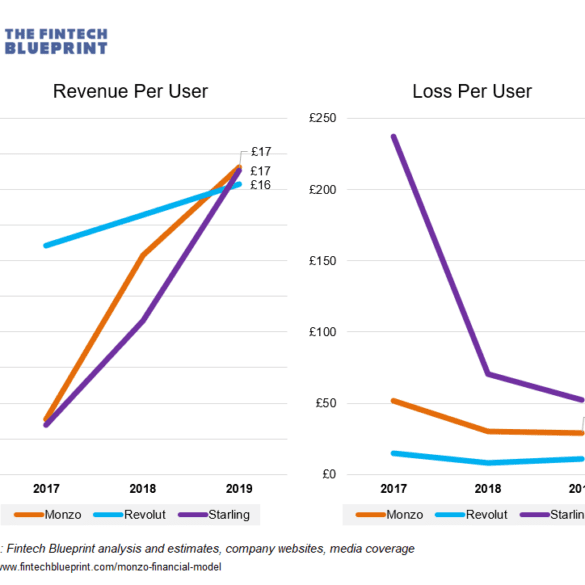

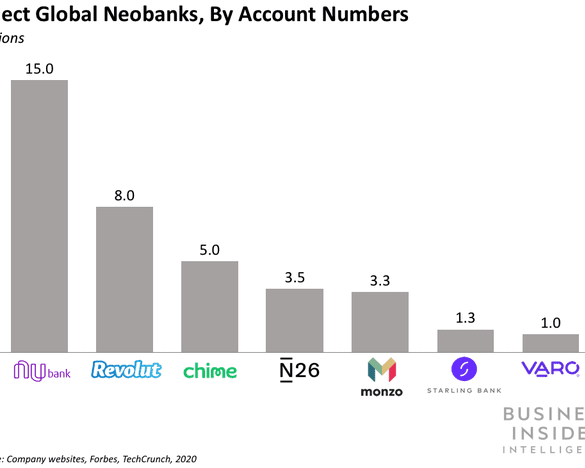

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

Digital bank Revolut extended their series D round to add an additional $80mn, which brings the total of the funding...

There is a growing group of fintechs who have designed their products specifically for Gen Z, who are defined as...

European challenger bank Revolut announced today that it will enter the US market with crypto trading services through a partnership...