Along with the challenging economic climate, Robinhood had issues of its own that affected their 2022 earnings.

Following a company-wide meeting Tuesday afternoon, CEO Vlad Tenev of the retail trading app Robinhood announced a 9% cut of staff.

On Thursday, online lender Enova International posted a $52 million profit on $320 million in revenue, up 57% from the same time last year. In addition, total originations increased 26% sequentially to a record $856 million. Despite the good news, the stock saw only a 4% rise before falling back toward its downward trend this month.

In episode 21 I talk with Martin Sokk and Mihkel Aamer of Lightyear. Lightyear is a simple and approachable way to invest your money globally without unnecessary barriers and fees.

In this video conversation we feature a roundtable by The Defiant exploring how and if the gap between Fintech and DeFi will be bridged.

DeFi Panelists

Lex Sokolin, head economist at ConsenSys

Santiago Roel Santos, angel investor

Spencer Noon, Investor at Variant

Vance Spencer, co founder at Framework Ventures

Fintech Panelists

Keith Grose, head of Plaid international

Nik Milanovi?, founder of This Week in Fintech

Simon Taylor, co-founder of 11:FS

Bruno Werneck, Business & Corporate Development at Plaid

Moderator

Camila Russo, Founder of The Defiant

Making news this week was the CFPB director testifying before both the Senate and House, Fidelity will allow bitcoin in 401(k) plans, Robinhood had a bad week, the OCC is talking stablecoins, Goldman created a lending facility backed by bitcoin and more.

The news this week was led by Apple with another fintech acquisition. We also had a big funding round for Ramp and Dave is getting into crypto with FTX US.

In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

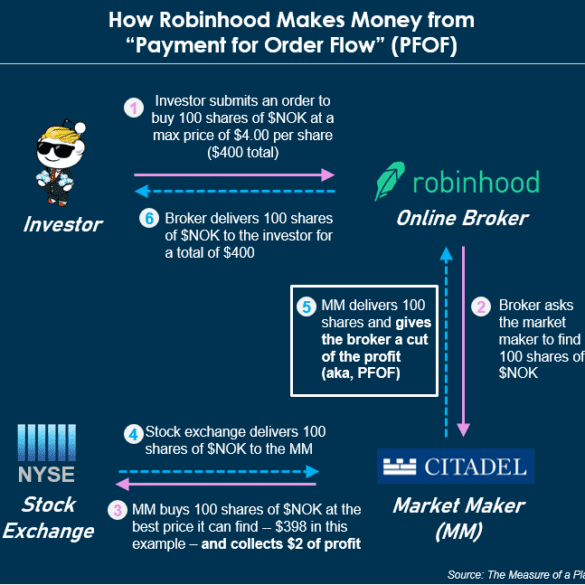

Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

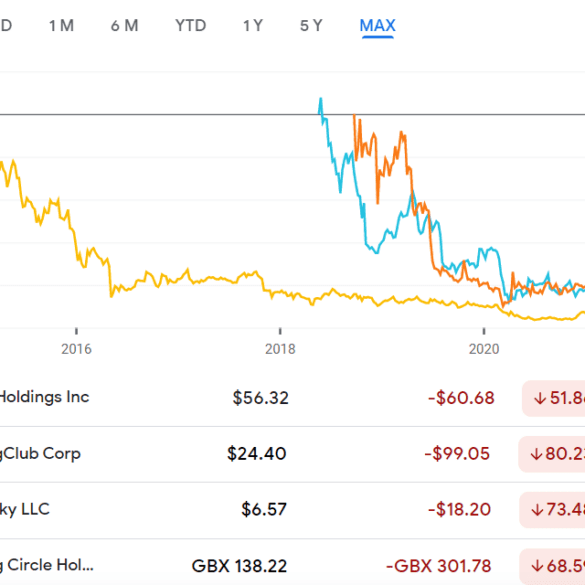

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.