In a long awaited move, the CFPB proposed a rule to improve consumer access to their financial data and drive the shift to open banking.

Fintechs have touted the importance of cashflow data in underwriting. This week, the CFPB published their evidence to support the approach.

In a blog post published yesterday, CFPB director Rohit Chopra suggests we now have a (somewhat) definitive timeline for implementation.

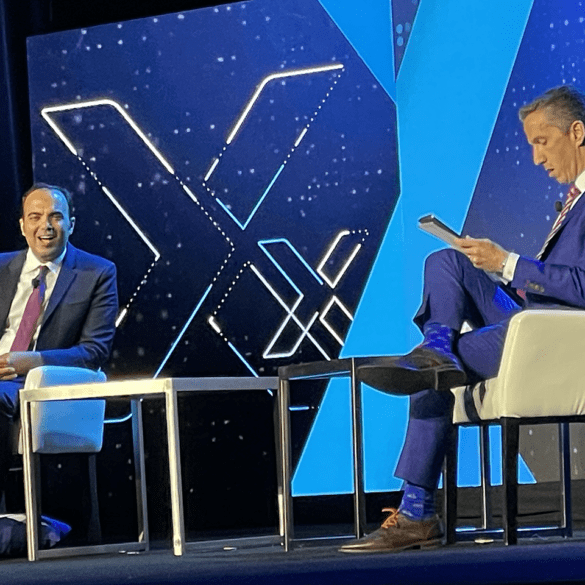

CFPB director Rohit Chopra lobbed a surprise grenade onto the expo floor Tuesday morning by announcing plans for an open banking rule.

CFPB Director Rohit Chopra has made it clear that he embraces an expansive view of the Bureau's authority to remedy inequities.

Artificial intelligence (AI) can significantly improve loan decisioning accuracy, but several factors must be considered to maximize that effectiveness. Luckily, given some care and consideration, Zest AI’s chief legal officer Teddy Flo said they can be easily applied.

CFPB director Rohit Chopra was back in front of the senate banking committee Tuesday, where he brought his focus on fraud in the P2P payments space.

BNPL providers should consider the FTC's suggestion to "conduct a compliance check," including reviewing their policies and procedures.

CFPB Director Rohit Chopra made it clear that repeat offenders of consumer protection laws will face harsher penalties than ever before.