Russia's invasion of Ukraine triggered a rapid wave of sanctions, bringing challenges for financial services firms looking to stay compliant.

This week, we look at:

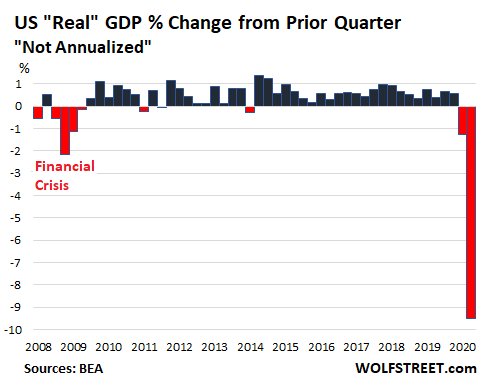

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

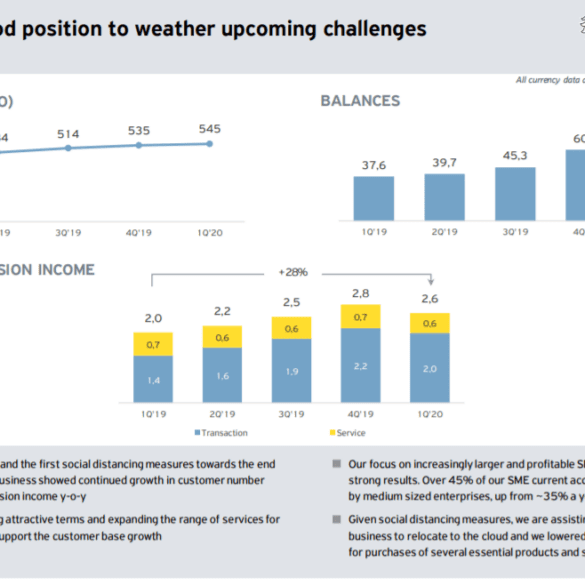

Oliver Hughes is the CEO of Tinkoff Group, one of the world’s most successful digital banking groups with over 10 million customers. This is one our most interesting conversation to date, full of fantastic operating advice.

Tinkoff is publicly listed with a $3.8 billion market capitalization, which brings clarity to its operating model in a time when many noteworthy consumer digital banks are pursuing customer acquisition at the expense of profitability.

Oliver has led Tinkoff through three financial crises, and brings experience and perspective to the current COVID crisis. This is a fascinating discussion about unit economics in digital banking and winning business models with a CEO with thirteen years of experience in this space.

ID Finance has partnered with Latvian marketplace lender Mintos to list its MoneyMan loans on the platform's marketplace; current loans will be issued to Spain ranging from EUR 300 ($326) to EUR 1,200 ($1,304) with a repayment period of 30 days to 4 months; ID Finance is the first network originator to offer Spanish listed loans on the Mintos platform providing for enhanced cross-border diversification. Source

Boris Batin and Alexander Dunaev have grown a successful lending startup after partnering together and launching ID Finance in 2012; the company is an online balance sheet lender that has been expanding throughout Russia, Europe and South America; the partners claim a digital lending business model that can launch and obtain profitability in nine months; part of their success is attributed to identifying challenging markets with growth potential that traditional banks have not entered. Source

Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade their currency's collapse.

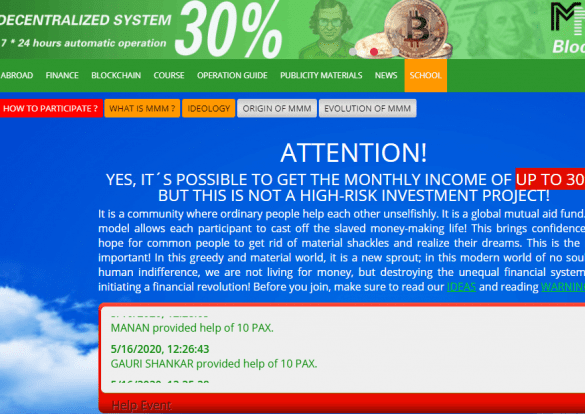

Let me introduce you to MMM. While decentralized finance and digital asset companies bend over backwards to be customer centric and reform financial services (each in their own way), MMM is a pretender. It is a pretender that has stolen the language of the crypto economy to create a cancer in its body.

Russian marketplace lender Blackmoon has launched Blackmoon Crypto for tokenized investment vehicles; seeks to support management of tokenized funds; Blackmoon Crypto is incorporated in Singapore; it will not initially be partnering for US investments however the firm is applying for a broker dealer license in the US. Source

Russian marketplace lender Blackmoon allows professional investors to acquire portfolios of emerging market loans; it has now reported a new partnership with ID Finance, a data science, credit scoring and nonbank digital lending as an application provider; loans are screened and scored by ID Finance's advanced risk assessment system and qualifying loan transactions are automatically transferred to the creditor setting up an automated securitization process. Source

Russia's Sberbank will integrate new artificial intelligence (AI) to replace 3,000 employees in its legal department; the AI solution follows comments from CEO Herman Gref in September 2016 which forecasted that 80% of the bank's decisions would soon be attributed to AI systems; as AI solutions evolve, regulators are considering industry standards and frameworks for changing labor markets. Source