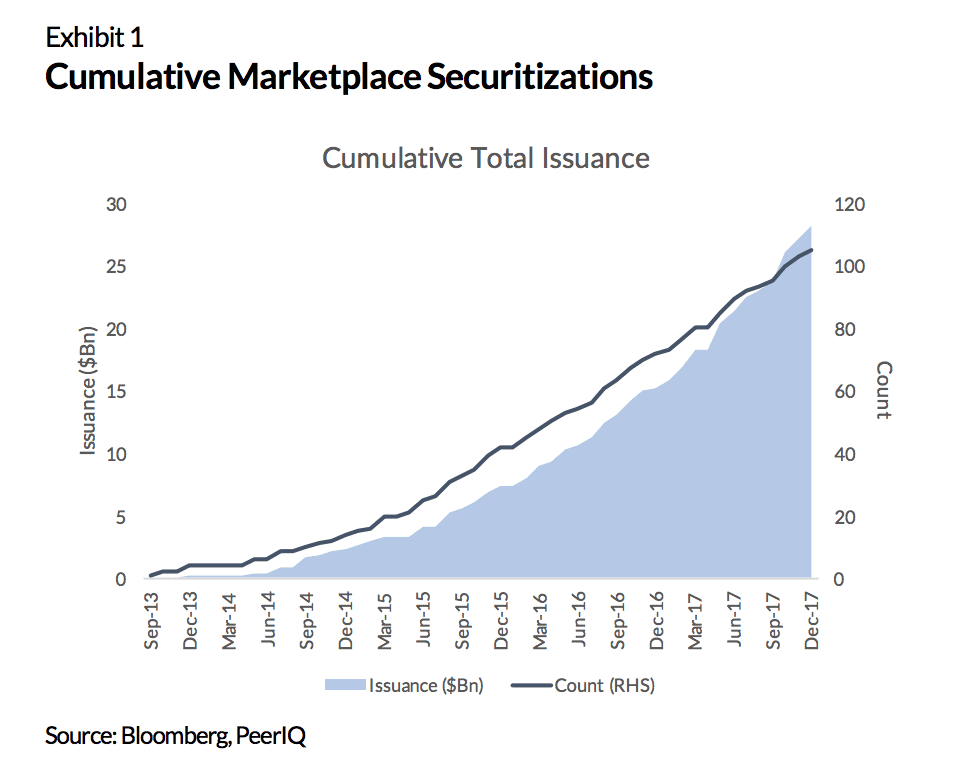

Cumulative issuance for marketplace lending securitization now totals $28.2 billion across 106 deals; Q4 2017 issuance totaled $4.4 billion which was another record quarter; SoFi issued the largest consumer and student lending deals ever; PeerIQ shares other highlights in their quarterly report. Source

The report shares the highlights of securitization in the space which totaled $7.8 billion in 2017, up from $4.6 billion in 2016; SoFi was the leader in both volume and total number of ABS deals; report includes KBRA’s outlook for 2018, loan origination and ABS issuance by platform, performance and rating trends and more. Source

The Senior Managing Director at Kroll Bond Rating Agency discusses trends in marketplace lending securitization. Source

CommonBond closed their fifth and largest securitization which contained $248 million of refinanced student loans; the senior tranches were rated by Moody’s, S&P and DBRS and received ratings of Aa2, AA and AA (high) respectively; the deal was four times oversubscribed; according to David Klein, CommonBond CEO and co-founder, “Investor demand for CommonBond paper has never been greater. The strong market reception is a reflection of our pristine credit quality, continued ratings progression, and track record of consistent results. As a programmatic issuer, we look forward to continuing to bring consistently high performing bonds to the market, providing investors with world-class capital deployment options.” Source

Once seen as a niche segment of finance online lenders are now originating billions in loans each year; the bigger they get the questions start to arise if they can handle an economic downturn and are their underwriting models good enough; American Banker digs into the overall industry by looking at securitization growth, whether or not traditional banking is dead and more. Source.

The easiest way to get insight into the marketplace lending securitization market is through PeerIQ’s quarterly reports. It feels like...

Micro-lenders in China have brought billions of packaged consumer loans to institutional investors in China; the market this year though may slow due to regulatory scrutiny according industry sources; the current leaders in this space include Ant Financial Services Group as well as groups within JD.com, Baidu, VIPShop Holdings and Xiaomi Technology. Source

On Friday of last week, LendingClub announced that it closed a new kind of transaction. It was a whole loan...

The latest securitization of Zopa loans priced tighter than last year’s; it was led by P2PGI and arranged by Deutsche Bank; the senior tranche was rated AA by Moody’s; Jaidev Janardana, Zopa’s CEO stated, “This is a further demonstration of investor and market confidence in our origination and underwriting capabilities. Our ability to originate high quality loans continues to make the Zopa investment asset a distinctive and attractive one to retail and institutional investors alike.” Source

PeerIQ released their third quarter marketplace lending securitization report; total issuance for the quarter was $2.6 billion down from $3 billion in the last quarter; SoFi closed two consumer deals and one student deal; Lending Club and Prosper both issued one deal; College Avenue issued their first ever student loan securitization. Source