In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

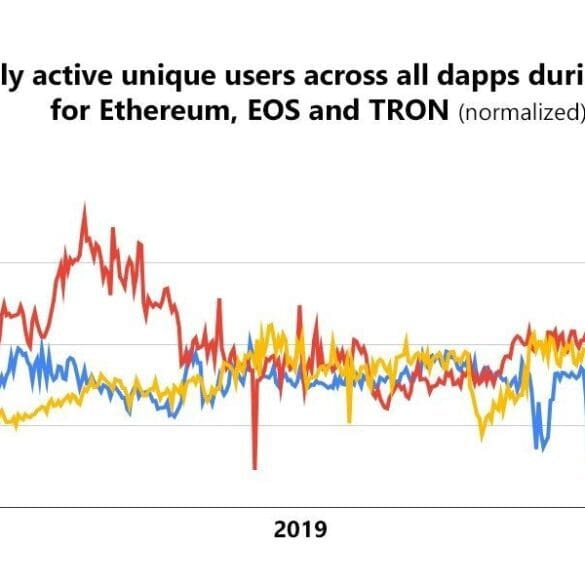

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

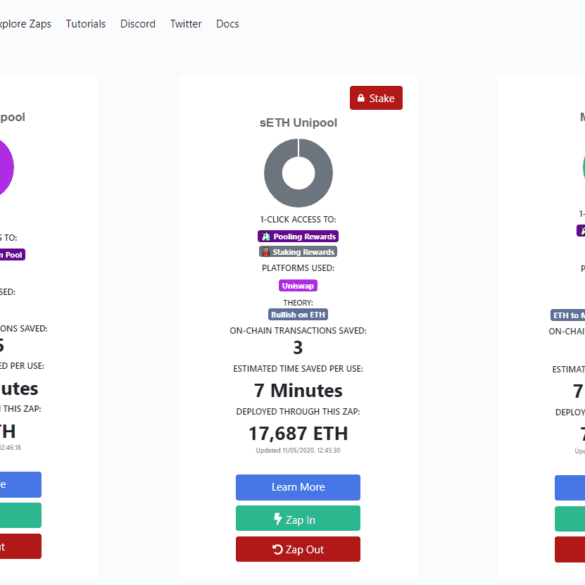

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

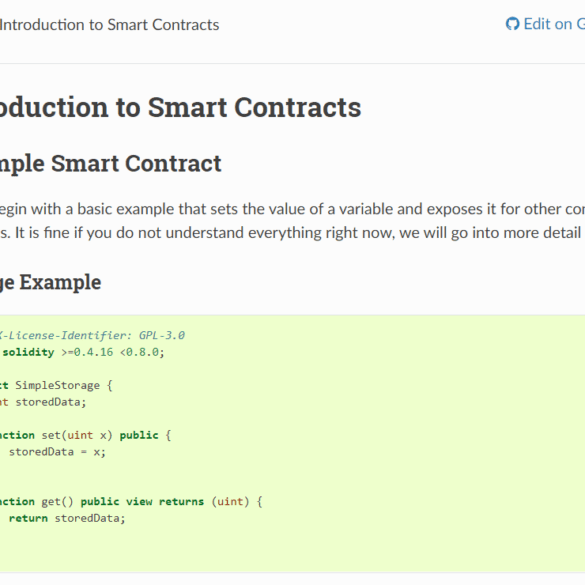

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.