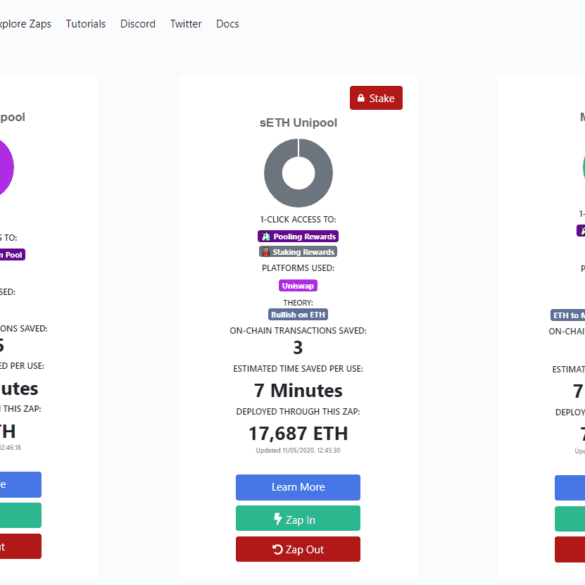

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

When SigFig first launched they were one of the only companies disrupting the wealth management space and were seen as...

Wells Fargo, Morgan Stanley, JPMorgan Chase and others have launched or will launch their own robo products to compete with slicker startups; after seeing the success of startups in the space the banks realized they needed to improve their offerings to keep customers and attract newer, younger ones; the trend to move away from white labeling technology to building their own is a recent one as some traditional players like UBS, State Street and John Hancock are still using services from SigFig, Motif or NextCapital. Source.

The current crisis has highlighted some of the key areas where banks fall short with their customers; while writing in...

Digital wealth management fintech SigFig has launched their new SigFig Atlas platform for banks as the startup looks to take...