Could AI have prevented the SVB crisis? Maybe not completely, but consumer sentiment analysis could have dramatically reduced its impact.

The Silicon Valley Bank collapse highlighted the importance of a little-discussed but key feature of healthy banks and fintechs - backup servicing.

Making news this week were First Citizens Bank, Early Warning (Paze), Apple, big banks vs small banks, the FDIC, venture capital, Binance, HM Treasury and more.

This week we sat down with Michele to talk about the outlook for financial institutions an innovation in the wake of the SVB crisis.

We will be live-updating the Silicon Valley Bank crisis story as new developments emerge through the weekend.

Capstack Technologies’ founder and CEO Michal Cieplinski believes he has the antidote to the Silicon Valley Bank meltdown, and Citi Ventures agrees.

Silicon Valley Bank is still open for business for fintech companies. In many ways, even though it is now part of First Citizens Bank, it is very similar to what it was before, at least from a fintech perspective.

Arc were one of the self described first responders of the SVB crisis. They have now launched gold to help startups easily diversify risk.

Books will be written and movies will be made about the last seven days as it was the most dramatic week in finance since the financial crisis of 2008.

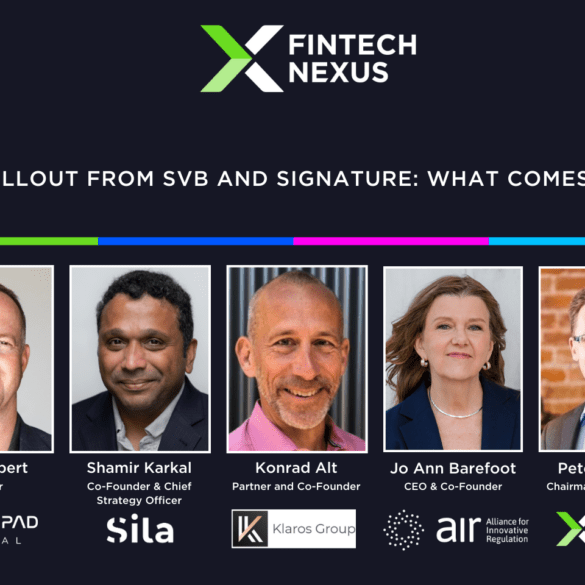

A week on from Silicon Valley Bank's fall, Fintech Nexus hosted a webinar to discuss what happened and what's next for the institution.