A casualty of FTX's "ripples" or another cog in a crypto's poorly regulated CeFi machine that is casting a shadow on the industry?

The popularity of crypto is rising. Stablecoins have presented a significant opportunity for settlement, but how should banks respond? This, and more were discussed at Fintech Nexus 2022.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

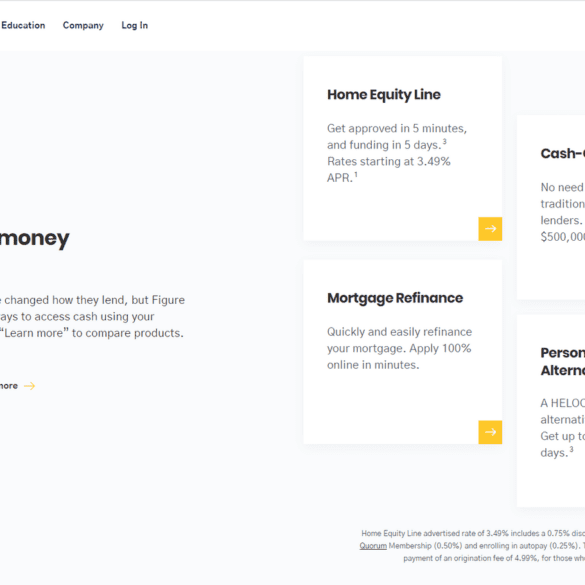

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Making fintech news this week were Silvergate Bank, Klarna, Goldman Sachs, Marqeta, LendingTree and more

Silvergate, a US-based crypto bank that first partnered with the Facebook venture to create a stable coin last May, said in a release they paid $182 million for the operations infrastructure.

While most big banks are reluctant to enter into the crypto space, many smaller banks are capitalizing on the opportunity;...