Local lenders in Singapore are offering consumers and small businesses relief during the current crisis; this includes a freeze on...

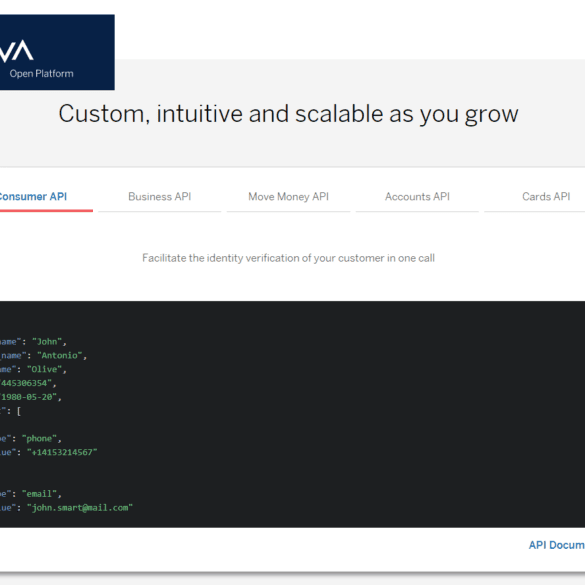

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

Singapore based fintech company Trade Finance Market (TFM) recently launched their Invoice Check solution to cut down on trade finance fraud; the new blockchain based registry will help stop invoices from being paid more than once; they built the solution in the past year on the ethereum blockchain and it uses smart contracts; "Our system is in public beta and provides a manual method of entering invoices and having them checked against a blockchain-hosted database. This data is stored on the blockchain and funders are alerted if there is a potential risk of double financing," Raj Uttamchandani, the company's executive director, tells Global Trade Review. Source

Funding Societies is the first P2P lender to join the International Association of Credit Portfolio Managers (IACPM); the IACPM was established in 2001 and is focused on supporting a community of members in the practice of credit portfolio management; the Association currently has approximately 100 financial institution members. Source

Marvelstone Capital is working with fintech startup Smartfolio to develop a robo advisor solution for family offices; it will target family offices based in Singapore, Malaysia, Indonesia, Myanmar and India; the robo advisor solution is being designed as a hybrid service for family offices with less than US$1 billion in AUM however Marvelstone will also market to family offices with AUM of US$1 billion to US$10 billion; it plans to launch the new solution in the third quarter of 2017. Source

Grab is a well known ride-hailing app in Singapore; now they are acquiring Bento, a wealth management startup; they plan...

The CEO of DBS Group Holdings in Singapore believes that Singapore may follow Hong Kong in offering virtual banking licenses;...

Singapore's LATTICE80 fintech hub has announced it will expand to London; it has registered as an entity and is seeking a location with plans to open by 2018; the expansion builds on the "Fintech Bridge" agreement signed by the UK and Singapore in 2016 to promote cross border collaboration; LATTICE80 is owned and operated by Singapore-based private investment firm Marvelstone Group which is actively developing new fintech services and solutions for the Asian and UK markets. Source

The regulator says, "digital tokens in Singapore will be regulated by the Monetary Authority of Singapore (MAS) if the digital tokens constitute products regulated under the Securities and Futures Act"; if digital tokens fall under the definition of securities in the Securities and Futures Act then issuers are required to register a prospectus with MAS and other requirements may also apply to associated parties; overall the statement from the MAS increases the level of compliance needed for an initial coin offering. Source

Singapore hosted the 3rd Singapore-Shanghai Financial Forum this week helping to strengthen relationships in the region; over 200 participants were in attendance; the theme of the event was "Strengthening Singapore-Shanghai Collaboration in a Changing Financial World Order" and discussions were centered around deepening financial connections between Singapore and Shanghai; Jacqueline Loh, deputy managing director of the Monetary Authority of Singapore, was a featured keynote speaker at the event and spoke about the opportunities for fintech collaboration in the region. Source