In the long take this week, I try out a contrarian point of view on personal finance chatbots. Trim, a savings chatbot, just withdrew support from Facebook Messenger. While lots of other chatbots are still invested in conversational banking, what could we take away from the counterfactual of chatbots failing to get B2C traction? What is the impact on the rest of the platform wars waged by Amazon, Google, and Tesla for connected homes, cars, and the Internet of Things?

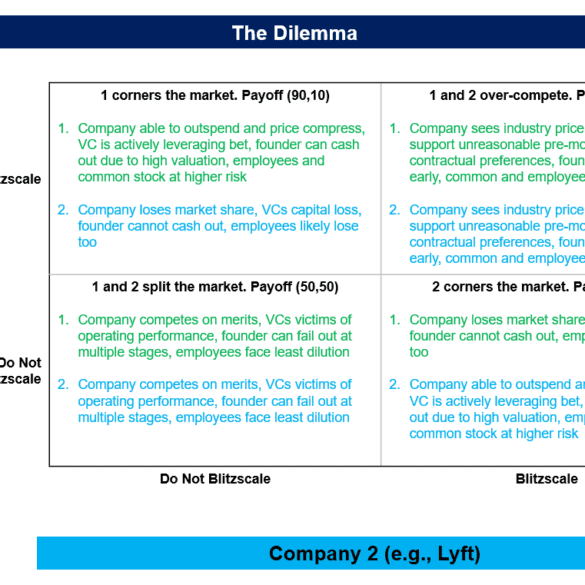

Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.