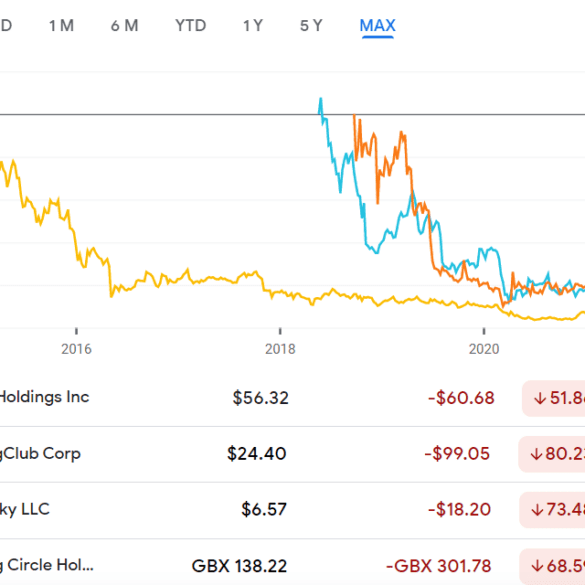

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

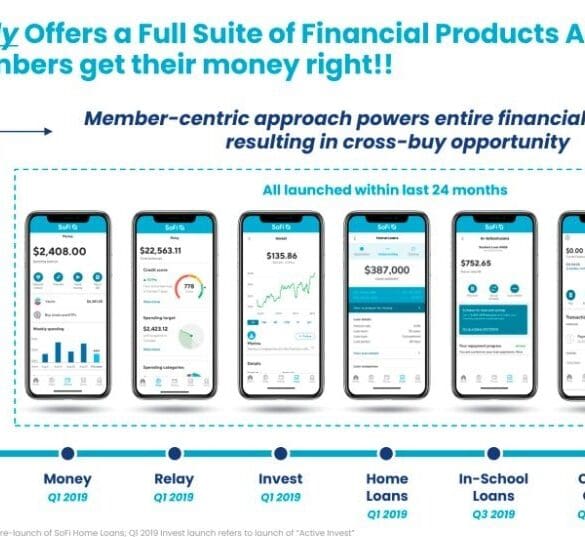

It has been a busy first quarter of 2021 for SoFi. The new year kicked off with the announcement that...

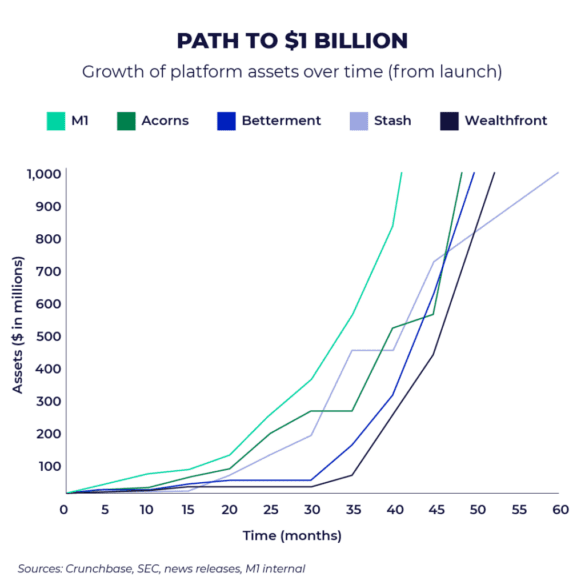

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

Big news from SoFi today. While we know that the company has been considering going public for some time, we...

Last Sunday night the world saw SoFi Stadium in all its glory for the first time. Well, that’s not exactly...

SoFi raised $2.4 billion in cash as part of the merger deal and the company said it will use the proceeds to “fuel growth, expand its markets and develop new products.”

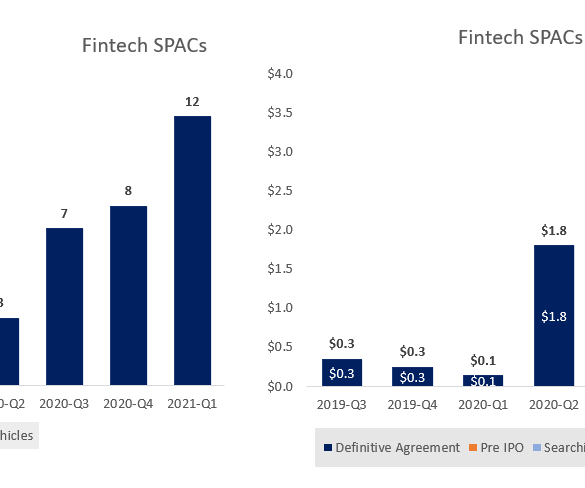

This week, we look at:

The $12 billion in cumulative SPAC capital focused on Fintech, of which $3.6 billion has been raised in 2021 Q1 alone

Analysis of the private and public financial services markets and their valuations of profitability and revenue

A deeper look at the fundamentals and business mix of SPAC targets MoneyLion, Payoneer, Apex Clearing, and SoFi

Not everything that glitters is gold

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

This week, we look at:

An overdue analysis of the SPAC structure, reflecting on the $75 billion size and stage of the market

Economics and regulatory paths of going public via investment bankers, SPACs, and direct listings

The marquee teams in Fintech looking to do deals, and what criteria for target selection look like

This week, we look at:

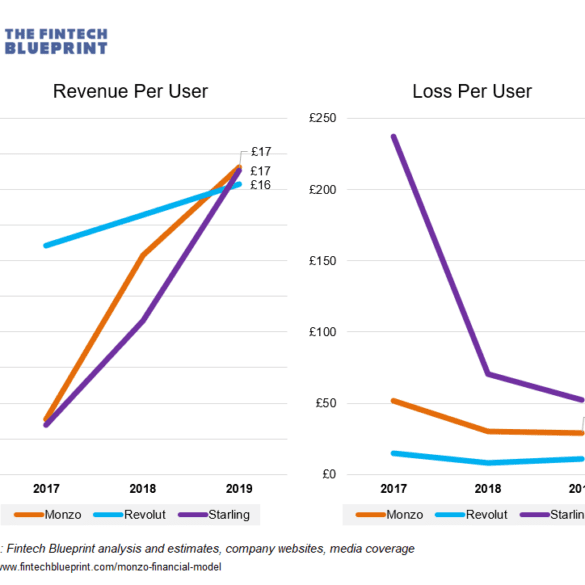

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce