Spain's fintech scene could rightly be perceived as mediocre, but with shifts in regulation and a natural link with LatAm, is change ahead?

ID Finance will collaborate with Yuri Popov and asset manager Da Vinci Capital to launch the FinTech Credit Fund; estimated fund value is $200 million with debt financing focused on fintech and alternative lending; ID Finance is a growing fintech firm with three businesses: MoneyMan, Ammopay and Solva. Source

Upon their acquisition of Zencap, Funding Circle took up operations in Germany, the Netherlands and Spain, though now you can remove Spain from that list; according to Ryan Weeks of AltFi, this was due in large part to a low quality pool of borrowers and limited understanding in Spain of P2P lending; in terms of their loan book this was only a fraction of global originations for Funding Circle; they will now be able to allocate more resources to Germany and the Netherlands where they are looking to increase their market share. Source

Spanish bank CEO Carlos Torres Vila of BBVA spoke at the IESE 12th Banking Industry Meeting yesterday and explained how banks will need to adapt to stay competitive; BBVA has acquired cloud computing, invested in digital banks, built out artificial intelligence and improved their mobile banking experience in recent years; these changes are meant to address customer needs and position the bank for the future; he also believes banks need to adapt management structures to be more modular, which will also bring more innovative talent and facilitate better communication. Source

·

[Editor’s note: This is a guest post from Sergio Anton, co-founder and CEO of MytripleA. MyTripleA is an exhibitor and will be...

Extraordinary times call for extraordinary measures. The EU announced last week that it would suspend the Growth and Stability Pact....

ID Finance has partnered with Latvian marketplace lender Mintos to list its MoneyMan loans on the platform's marketplace; current loans will be issued to Spain ranging from EUR 300 ($326) to EUR 1,200 ($1,304) with a repayment period of 30 days to 4 months; ID Finance is the first network originator to offer Spanish listed loans on the Mintos platform providing for enhanced cross-border diversification. Source

Funding Circle has replaced German Managing Director Matthias Knecht who joined Funding Circle with the acquisition of Zencap and then left the firm in June of 2016; Thorsten Seeger will take the role of managing director; the firm has also hired Belkacem Krimi as chief risk officer for continental Europe; Funding Circle will also be closing its lending business in Spain which it acquired with the purchase of Zencap. Source

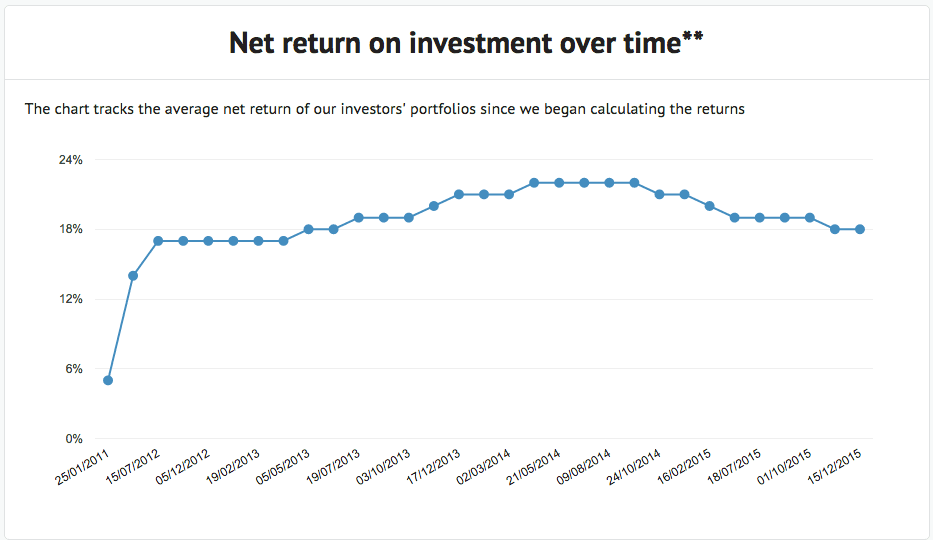

In the United States investment opportunities in marketplace lending have long been limited to US based platforms for individual investors. However,...