All of the leading online lenders are struggling as the economic crisis continues to get worse; many have cut originations...

Payments leaders PayPal and Square have both found the current crisis to be a challenge and a boost to their...

It has been an interesting to say the least as we have watched everything play out with the Paycheck Protection...

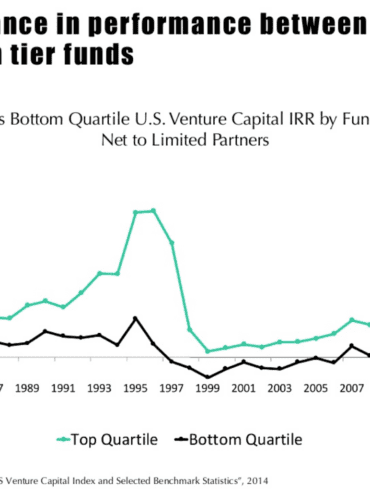

We look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

In this week’s PeerIQ Industry Update they cover the growing risk of a recession due to the coronavirus, though estimates...

Fintech lenders are hoping their participation in the Paycheck Protection Program will lead to working with the Small Business Administration...

The average loan size for PPP loans to date is $240,000 which fintech lenders have argues is catering to bigger...

It was reported over the weekend that PayPal and Intuit gained approval to lend through the Small Business Administration’s Paycheck...

Several CEOs have expressed their desire to help get government stimulus money into the hands of consumers and small businesses;...

The journey has been two and a half years in the making; Square has now officially received approval from regulators...