StashWorks is the new B2B offering from Stash, allowing any employer to add savings and investing as a benefit to employees.

While some firms are designed to pursue the ultra-wealthy, many are carving a niche in serving the investment needs of the rest of us. Two experts on the topic shared how it's done properly at Fintech Nexus USA 2023 today.

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

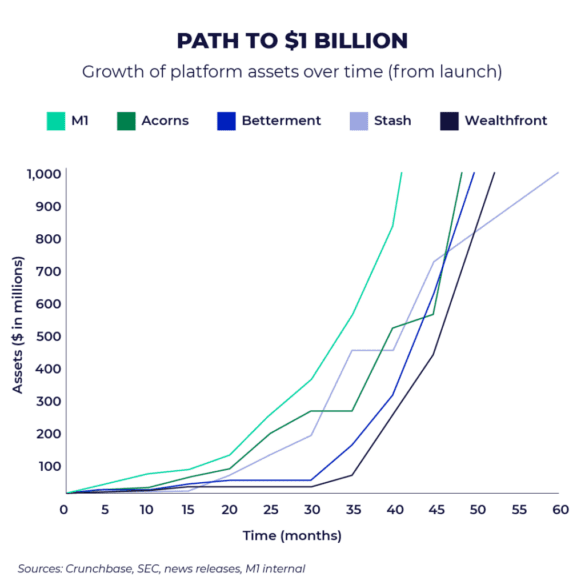

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

Hedosophia is not a household name, and that is by design. The fund is one of the most secretive investors...

Stash has quickly become one of the hottest fintechs and the company has seen continued success during the current pandemic;...

The CEO of Stash discusses how everyday Americans can create a better financial life through unique tools that make investing easy and affordable

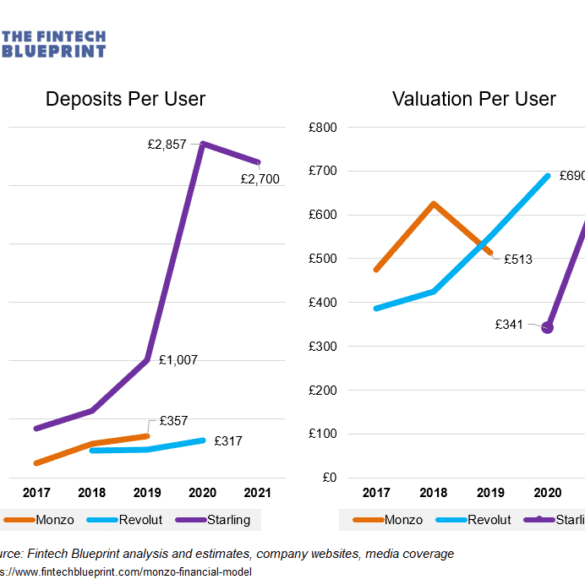

The fintech industry is coming up on the tipping point of funding, revenue generation, and user acquisition to rival traditional finance with $20 billion in YTD fintech financing, the several SPACs, and Visa’s $2B Tink purchased. Defensive barriers have eroded.

Let’s take a moment to compare capital. While it is not the money that wins markets, it is the transformation function of that money into novel business assets that does. And while the large banks have a massive incumbent advantage with (1) installed customers and assets, and (2) financial regulatory integration (or capture, depending on your vantage point), there is a real question on whether a $1 generates more value inside of an existing bank, or outside of an existing bank — even when it is aimed at the same financial problem.

This week, we look at:

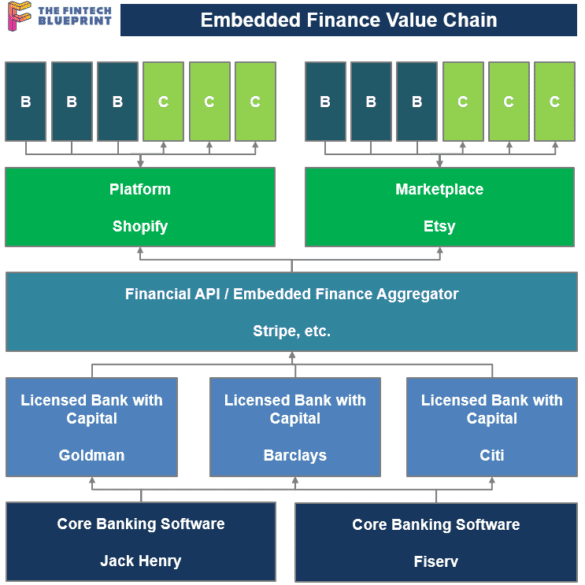

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

Stash opens the metrics kimono regarding growth during the pandemic How Sunrise Banks and Anvil onboarded $127M in PPP loans...

Digital banking startup Stash has been running virtual stock parties during the quarantine as a means of engaging their user...