Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

This week, we look at:

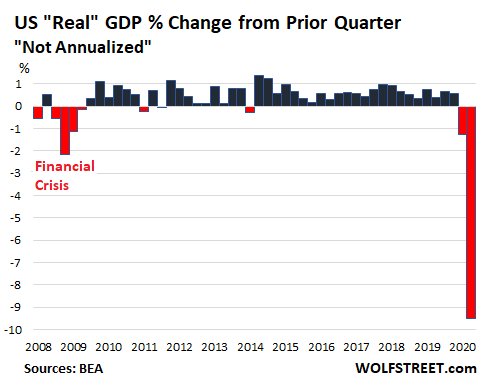

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

This week, we look at:

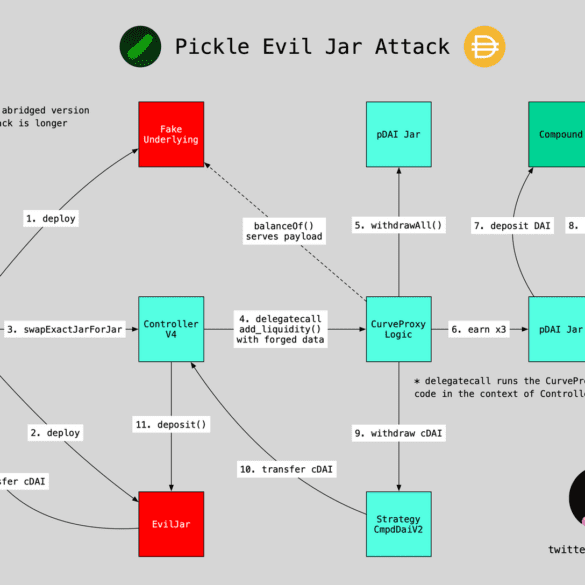

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

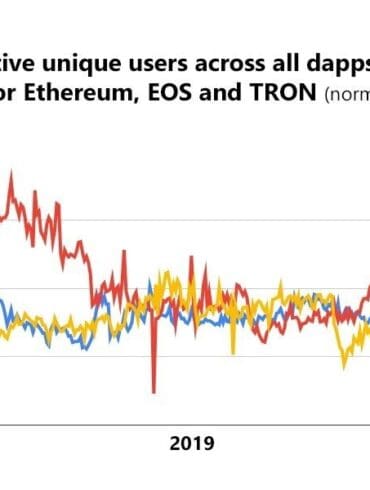

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!