Hope is the author of Open Banking and the rise of Banking-as-a-Service, a recent Temenos whitepaper that dives into these issues.

This week, we look at:

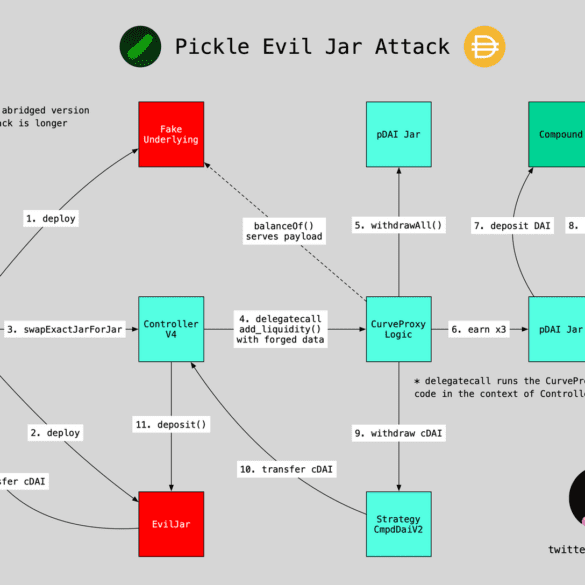

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

Green Dot Eyes Banking-As-A-Service, Gen Z To Build On Q4 Growth $650 billion asset manager Franklin Templeton is embedding data...

A new report titled “Whose Customer are you? The reality of digital banking” by Temenos shares that a majority of...

By the end of 2020, the Central Bank of Brazil launched its own instant payment system, called PIX, with the ambitious goal of speeding up and facilitating transactions.

After three long years and more than 5,000 pages of paperwork Varo Money has officially secured a national bank charter;...

A new survey, sponsored by Temenos and conducted by The Economist’s Intelligence Unit, of bank executives found 54 percent of...

Peter Ryan of the software provider Temenos believes PSD2 has the potential to offer banks the personal touch they have lost; allowing consumers to share their data via APIs can allow banks to learn more about their customers and offer tailored products; while some banks have been proactive there is a fair share of the market who fear open banking; better understanding of the potential in PSD2 will help banks embrace what’s ahead. Source.