Although the final restrictions of the COVID-19 pandemic have almost been lifted, its effect continues to mark the UK SME landscape.

Barclays, Lloyds, NatWest, Santander, RBS, Ulster Bank, Danske Bank and Clydesdale & Yorkshire Bank are the eight banks that are...

ThinCats recently shared that an agreement with four institutional investors allows it to lend £700 million to small businesses; the...

UK online marketplace lender ThinCats is the latest P2P platform to receive full authorization from the Financial Conduct Authority (FCA); the firm is a secured business lender and says it has a number of developments in progress including the launch of an IFISA; in comments regarding the authorization, John Mould, CEO of ThinCats, said: "We are delighted to have been granted FCA authorization, proving the dedication of our team and processes. We are very happy that more and more alternative finance providers are now being authorized, as it ultimately proves that the industry deserves the trust and confidence of investors, advisors and SME borrowers alike." Source

ThinCats has received endorsements from the National Association of Commercial Finance Brokers (NACFB) and Defaqto for its business operations in the P2P lending industry in the UK; the NACFB has recognized ThinCats for its best practices within commercial finance brokerage activities and ThinCats has joined the NACFB as a patron; ThinCats has also been recognized by Defaqto with a 5-star rating for product quality and comprehensiveness. Source

[Editor’s note: This is a guest post from Ryan Weeks, formerly with Dow Jones and AltFi, covering fintech. This is...

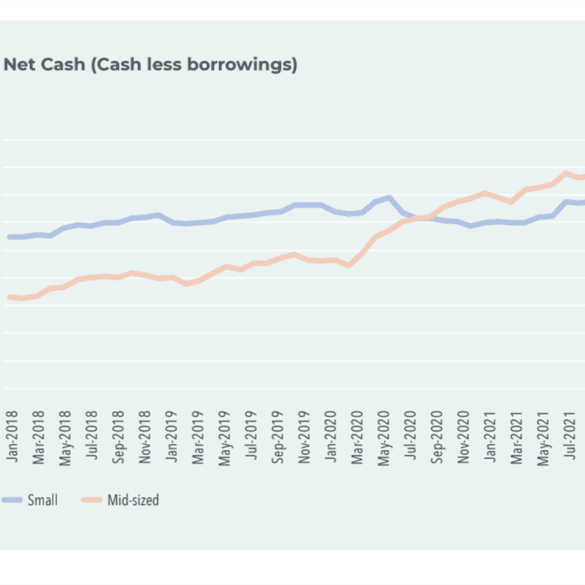

Funding Circle has struggled in the public markets since their IPO in 2018; now Funding Circle and their peers have...

After receiving FCA authorization earlier this month, ThinCats provides some insight on plans for its IFISA; Stewart Cazier, head of retail for ThinCats, says the company is planning for a 2017 release of its IFISA; Cazier also says the firm is planning a staggered rollout with registered investors receiving first priority. Source

A partnership with DomaCom has helped ThinCats Australia offer its first mortgage loan on residential property; the funder of the firm's first mortgage-backed loan requested a loan-to-value ratio of 36% resulting in a A$212,000 interest-only loan with a term of 24 months and interest rate of 6.5%; prior to the residential property lending expansion, ThinCats has primarily been focused on small business loans. Source