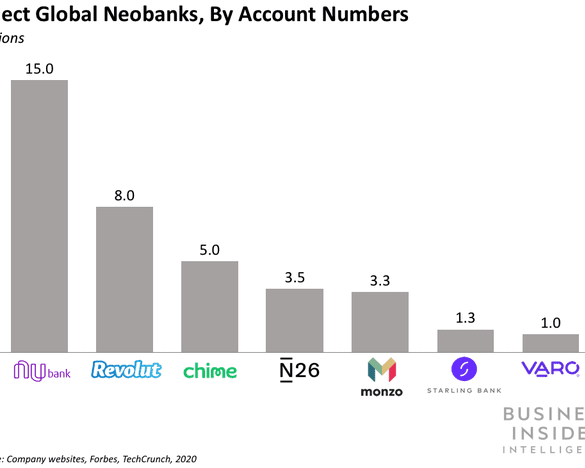

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

Today, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

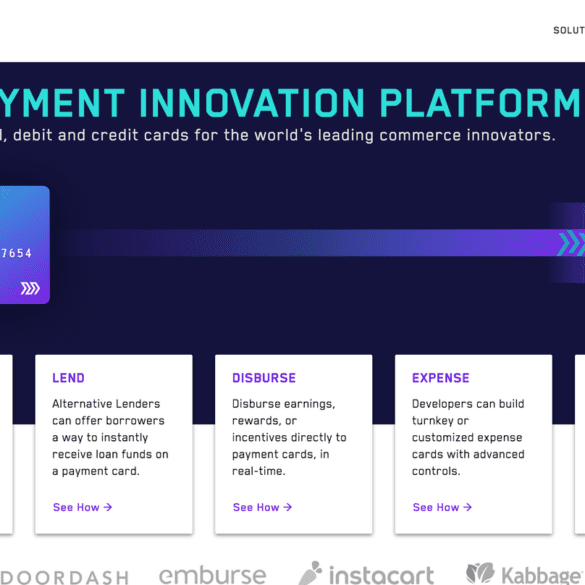

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

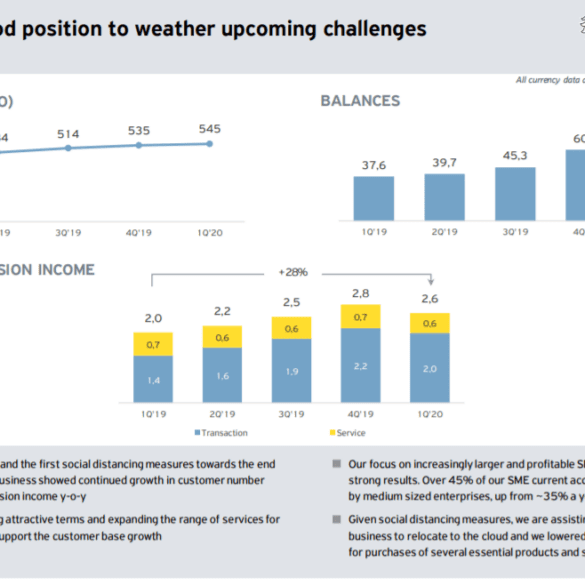

Oliver Hughes is the CEO of Tinkoff Group, one of the world’s most successful digital banking groups with over 10 million customers. This is one our most interesting conversation to date, full of fantastic operating advice.

Tinkoff is publicly listed with a $3.8 billion market capitalization, which brings clarity to its operating model in a time when many noteworthy consumer digital banks are pursuing customer acquisition at the expense of profitability.

Oliver has led Tinkoff through three financial crises, and brings experience and perspective to the current COVID crisis. This is a fascinating discussion about unit economics in digital banking and winning business models with a CEO with thirteen years of experience in this space.

Stripe is rolling out Terminal across the US Facebook’s ‘stablecoin’ punt raises questions for regulators Norway financial giant DNB to...