Facebook plans to reveal their crypto plans next week and now they count a group of impressive backers to support...

Back in January, Uber sold their subprime-lending unit to the startup Fair; according to PaymentsSource, “…this gave the startup access...

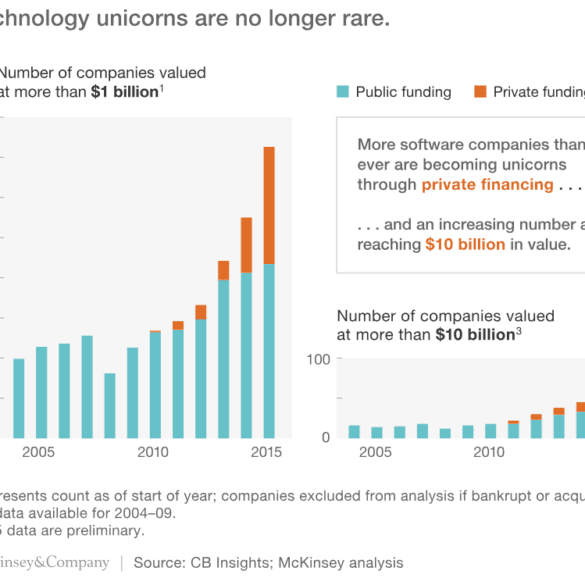

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

As financial services continues to become more digital there are a number of lessons they can take from leading companies...

Ant Financial is looking to raise a new $5bn round that would take the company’s value north of $100bn; the FT reports that the new round might begin later this month; if the valuation is as much the company would be worth more than Uber who right now is worth about $68bn; the biggest reason behind such a lofty valuation is the data collected on users according to Thomas Olsen, partner at Bain consultancy. Source.

Uber is working towards offering more financial products hiring dozens of employees in New York; sources say that the team...

Banking as a service is taking root in some of the country’s largest brands; at a conference this week the...

A new report by the Financial Stability Board (FSB) says big tech firms could reach scale very quickly in financial...

American Banker takes a look at 6 ways payments has become a prominent theme during the Super Bowl; pizza chains...

Go-Jek is an Uber competitor and is now looking to lead in the payments sector in Indonesia; the company purchased offline payments service Kartuku, payment gateway Midtrans and a saving and lending firm called Mapan. Source